What Is Mortgage Pre-Approval (And Why It Matters)

Buying a home is one of the biggest financial decisions you’ll ever make and if you’re planning to finance your purchase with a mortgage, one of the first steps is getting pre-approved.

But what exactly is mortgage pre-approval, and why is it so important?

Whether you’re a first-time homebuyer or returning to the market after years, understanding pre-approval can help you shop smarter, negotiate stronger, and close faster.

✅ What Is Mortgage Pre-Approval?

Mortgage pre-approval is a lender’s written offer to loan you a specific amount of money under certain terms, based on a review of your financial profile.

It’s not a full loan approval but it’s a strong indication that you qualify for a mortgage and tells sellers you’re a serious buyer.

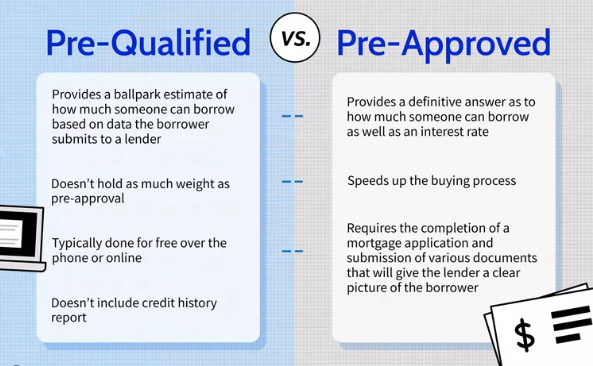

🔍 Pre-Approval vs. Pre-Qualification: What’s the Difference?

Many people confuse these terms, but they’re not the same:

| Term | What It Means | Accuracy Level |

|---|---|---|

| Pre-Qualification | An estimate of how much you might borrow based on self-reported info | Low |

| Pre-Approval | A formal review of your credit, income, and finances with supporting documents | High |

Pre-approval carries more weight with real estate agents and sellers — especially in a competitive housing market.

📑 What Does the Pre-Approval Process Involve?

When applying for pre-approval, you’ll need to provide:

📄 Documents Typically Required:

-

Recent pay stubs or proof of income

-

W-2s or tax returns (last 2 years)

-

Bank statements

-

Employment verification

-

Credit check authorization

-

ID (driver’s license or passport)

The lender uses this information to calculate how much you can afford and determines your debt-to-income (DTI) ratio.

💵 What You’ll Learn from a Pre-Approval Letter

After reviewing your documents and running your credit, the lender issues a pre-approval letter. This document includes:

-

The maximum loan amount you’re approved for

-

The loan type (conventional, FHA, etc.)

-

A preliminary interest rate estimate

-

The expiration date (usually valid for 60–90 days)

📌 Why Pre-Approval Matters

Here’s why you shouldn’t skip this step:

1. You Know Your Budget

Pre-approval shows how much house you can afford, which keeps your home search realistic and focused.

2. You Gain Credibility

Sellers are more likely to accept your offer if they know you’ve been pre-approved — especially in multiple-offer situations.

3. You Can Act Fast

Pre-authorisation shortens the timeline between making an offer and finalizing the mortgage, which can give you a competitive edge.

4. You Spot Problems Early

If there are issues with your credit or income, pre-authorisation gives you time to fix them before you start shopping.

Common Mistakes to Avoid After pre-authorisation

Getting pre-authorisation is great but it’s not the end of the road. Your financial situation will be reviewed again before final approval.

Avoid these red flags:

-

Don’t make large purchases (like a car)

-

Don’t open new credit cards or loans

-

Don’t switch jobs without informing your lender

-

Don’t deposit large sums of unexplained cash

These changes can affect your credit score or debt levels and may cause your loan to be denied at the last minute.

Final Thoughts

A mortgage pre-authorisation is one of the smartest first steps you can take as a homebuyer. It gives you clarity, credibility, and confidence and can help you move faster when the right property comes along.

Before house hunting, connect with a trusted mortgage lender or broker and start your pre-authorisation process. You’ll be one step closer to unlocking the door to your new home.