What Is Dollar-Cost Averaging? Does It Really Work?

Investing in the stock market can feel overwhelming especially when prices fluctuate daily. Should you buy when the market dips? Wait for a rally? What if you buy at the wrong time?

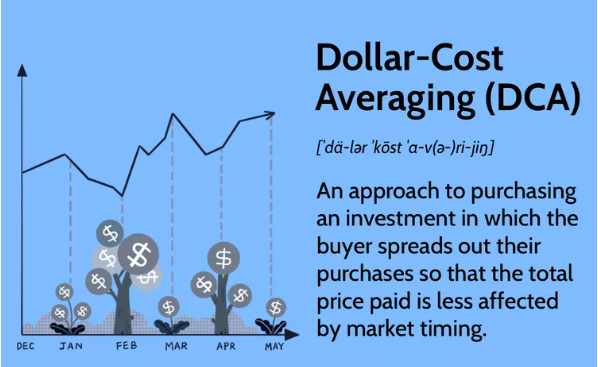

Enter Dollar-Cost Averaging (DCA) a strategy designed to take the guesswork (and stress) out of timing the market.

In this blog post, we’ll explain what dollar-cost averaging is, how it works, its pros and cons, and whether it’s the right strategy for you.

What Is Dollar-Cost Averaging (DCA)?

Dollar-cost averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the asset’s price.

Instead of investing a large lump sum all at once, you spread out your investment over time. This means you buy more shares when prices are low and fewer shares when prices are high—averaging out the cost per share over the long run.

🧮 How Does It Work?

Let’s say you decide to invest $100 every month into a stock or mutual fund:

| Month | Stock Price | Shares Bought | Total Shares |

|---|---|---|---|

| Jan | $20 | 5 | 5 |

| Feb | $25 | 4 | 9 |

| Mar | $10 | 10 | 19 |

| Apr | $20 | 5 | 24 |

In this example:

-

You invested $400 total.

-

You bought 24 shares.

-

Your average cost per share = $400 ÷ 24 = $16.67.

Compare that to the average price of the stock over four months ($20 + $25 + $10 + $20) ÷ 4 = $18.75.

Thanks to DCA, your average cost per share is lower than the average market price during that time.

✅ Benefits of Dollar-Cost Averaging

1. Reduces the Risk of Market Timing

Timing the market is difficult—even for professionals. DCA helps reduce the risk of making poor decisions based on short-term market movements.

2. Builds Investment Discipline

Investing regularly helps build a consistent habit and keeps emotions in check. You stay invested whether the market is up or down.

3. Takes Advantage of Market Dips

Because you’re buying regardless of price, you naturally buy more shares when prices drop—turning market downturns into buying opportunities.

4. Ideal for Beginners

DCA is a simple, low-stress way to get started with investing—especially if you’re working with a limited budget.

❌ Drawbacks of Dollar-Cost Averaging

1. May Miss Out on Bigger Gains

If the market is trending upward consistently, lump-sum investing might yield higher returns than DCA.

2. Doesn’t Guarantee Profits

While DCA can lower your average cost per share, it doesn’t protect you from overall market losses.

3. Not Always the Most Efficient

If you have a large sum of money ready to invest, delaying your entry with DCA might cost you returns compared to investing it all at once (especially in bull markets).

📊 DCA vs. Lump-Sum Investing

| Feature | Dollar-Cost Averaging | Lump-Sum Investing |

|---|---|---|

| Risk Level | Lower (short-term risk) | Higher (short-term) |

| Market Timing | Not required | Crucial |

| Ideal Conditions | Volatile or uncertain market | Rising markets |

| Emotional Control | Easier to maintain | Harder (emotion-driven decisions) |

| Best For | New or cautious investors | Confident or experienced investors |

🧠 When Should You Use DCA?

-

You’re just starting out and investing a portion of your income regularly (e.g., monthly).

-

You’re investing in volatile markets and want to reduce risk.

-

You don’t have a lump sum to invest but want to build wealth over time.

-

You want a hands-off, automated approach.

🏁 Final Thoughts: Does DCA Really Work?

Yes—dollar-cost averaging works, especially as a long-term strategy for disciplined investors. It won’t always outperform lump-sum investing, but it can help smooth out the impact of market volatility and reduce emotional decision-making.

If you’re new to investing, have limited funds, or want to take a slow and steady approach, DCA is a proven strategy worth considering.