What Are Payday Loans and Why You Should Be Cautious

When you’re short on cash and an emergency strikes, a payday loan might look like a quick fix.

These loans promise fast money sometimes in just minutes but they come with sky-high costs and serious risks.

Before you consider one, let’s break down what payday loans are, how they work, and why you should think twice before signing on the dotted line.

What Is a Payday Loan?

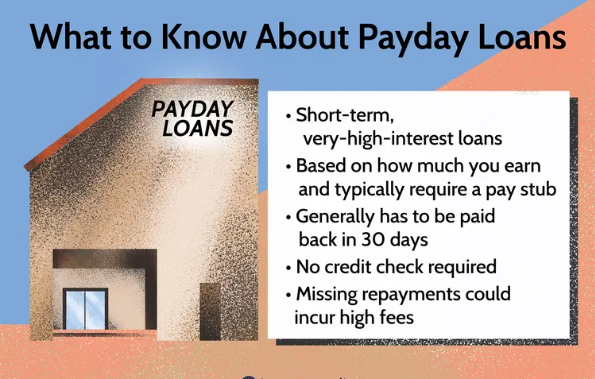

A payday loan is a short-term, high-cost loan that’s typically due on your next payday.

They are often for small amounts usually between $100 and $1,000 and are marketed as a way to cover urgent expenses until your next paycheck.

-

How it works:

-

You borrow a small amount of money.

-

You agree to repay it (plus fees) by your next payday.

-

The lender either takes a post-dated check or gets permission to withdraw the money from your bank account.

-

The Appeal

-

Speed: Approval can happen in minutes.

-

No credit check: Most payday lenders don’t require good credit.

-

Convenience: Available online or at storefront locations.

It’s easy to see why someone facing an emergency might turn to them. But here’s the catch…

Why You Should Be Cautious

Payday loans are one of the most expensive forms of borrowing.

1. Extremely High Interest Rates

-

APRs (Annual Percentage Rates) often range from 300% to 600% or more.

-

For example, borrowing $500 for two weeks might cost you $75 in fees—equivalent to a 391% APR.

2. Short Repayment Period

-

You may have only two weeks to pay back the full amount plus fees.

-

If you can’t, you may need to take out another payday loan—starting a dangerous cycle of debt.

3. Debt Trap Risk

-

Many borrowers roll over loans multiple times, paying new fees each time.

-

This can lead to paying more in fees than the original loan amount.

4. Aggressive Collection Practices

-

If you miss a payment, lenders may withdraw money directly from your bank account, causing overdraft fees.

-

Some may threaten legal action.

Safer Alternatives

If you’re facing a cash crunch, consider these options first:

-

Credit union small-dollar loans – Lower rates and more flexible repayment.

-

Personal loans – Even with average credit, rates are far lower than payday loans.

-

Payment plans with service providers – Many companies will work with you if you ask.

-

Emergency assistance programs – Nonprofits and local agencies can help cover basic needs.

Bottom Line

Payday loans should be an absolute last resort.

While they can provide quick cash, their high costs and short repayment terms can trap you in a cycle of debt that’s hard to escape.

If you must use one, borrow the smallest amount possible and have a clear plan to repay it on time—otherwise, the “quick fix” can turn into a long-term financial headache.