Understanding Market Cycles and Investor Psychology

The stock market, like life, moves in cycles periods of growth followed by periods of decline and recovery. These ups and downs aren’t just driven by economic data; they’re deeply influenced by investor psychology.

To be a successful investor, it’s not enough to understand financial statements or market trends. You also need to understand the emotions and behaviors that drive the market and how to manage your own.

In this post, we’ll break down market cycles, how investor psychology influences them, and how you can stay calm and confident through the noise.

📈 What Are Market Cycles?

A market cycle is the natural rise and fall of the stock market over time. Each cycle has four key phases:

1. Accumulation Phase

-

The market has bottomed out after a decline.

-

Smart money (institutional investors) starts buying undervalued assets.

-

General investor sentiment is still negative or cautious.

2. Markup Phase

-

Optimism returns, and prices rise steadily.

-

More investors jump in as confidence grows.

-

Economic indicators improve and earnings rise.

3. Distribution Phase

-

Prices reach unsustainable highs.

-

Volatility increases.

-

Smart money begins selling to lock in profits.

-

Retail investors are often still buying.

4. Decline (or Markdown) Phase

-

The market begins to fall.

-

Panic and fear take over.

-

Many investors sell at a loss.

-

Eventually, the cycle resets.

🧠 Investor Psychology: The Emotional Side of Investing

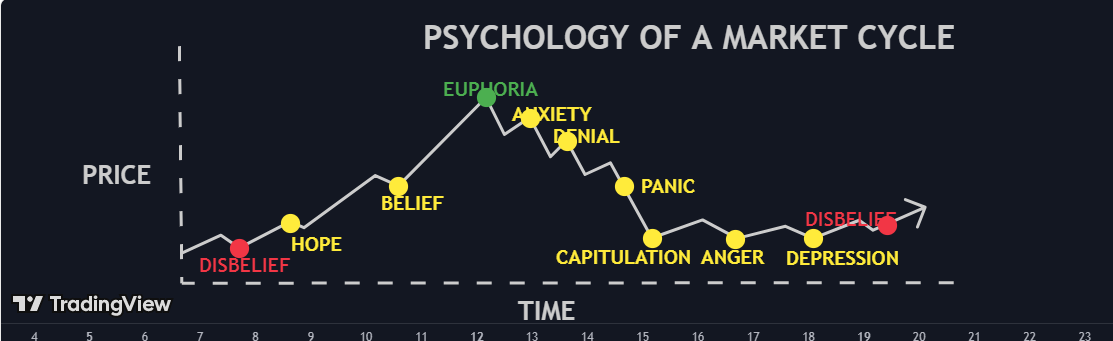

Market cycles are driven in part by emotions. Here’s how psychology plays out across a typical cycle:

| Market Phase | Dominant Emotion |

|---|---|

| Accumulation | Caution, disbelief |

| Markup | Optimism, excitement |

| Distribution | Greed, overconfidence |

| Decline | Fear, panic, despair |

Let’s explore these emotions in more detail:

🟢 Euphoria

-

“This time it’s different!”

-

Investors throw caution to the wind.

-

Valuations become detached from fundamentals.

🔴 Panic and Capitulation

-

Investors start selling out of fear.

-

Losses mount, and many give up entirely.

-

This is often the best buying opportunity.

🟡 Hope and Recovery

-

As markets begin to stabilize, confidence returns.

-

Investors who stayed the course often see the most benefit.

📉 Why Most Investors Buy High and Sell Low

Due to emotional decision-making, many investors:

-

Buy during euphoria, when prices are at their peak.

-

Sell during panic, when prices are near the bottom.

This behavior leads to poor returns, even when the broader market is growing over time.

“The investor’s chief problem—and even his worst enemy—is likely to be himself.” – Benjamin Graham

🔁 History Repeats Itself

Market cycles are not new. Throughout history, we’ve seen them repeat with different causes:

-

Dot-com Bubble (1999–2000): Tech stocks soared and crashed.

-

Global Financial Crisis (2008): Housing market collapse led to global panic.

-

COVID-19 Crash (2020): Rapid drop and rebound due to global uncertainty.

In each case, investor psychology played a major role in both the boom and the bust.

🛡️ How to Protect Yourself from Emotional Investing

Here are some strategies to help you stay grounded:

1. Have a Long-Term Plan

Invest with a clear goal and time horizon in mind. Don’t react to every market dip or headline.

2. Stick to Your Strategy

Whether you’re using dollar-cost averaging, value investing, or index funds—stay consistent.

3. Ignore the Noise

The media thrives on fear and hype. Stay focused on facts, not headlines.

4. Diversify

Spread your investments across assets and industries to reduce risk and smooth out volatility.

5. Recognize Your Biases

Understand your emotional triggers—fear, greed, FOMO—and learn to pause before reacting.

✅ Final Thoughts

Understanding market cycles and investor psychology is key to becoming a disciplined, confident investor. While you can’t predict every market move, you can prepare for them by recognizing the patterns of human behavior that repeat time and again.