Types of Mortgages Explained: Fixed vs. Adjustable Rates

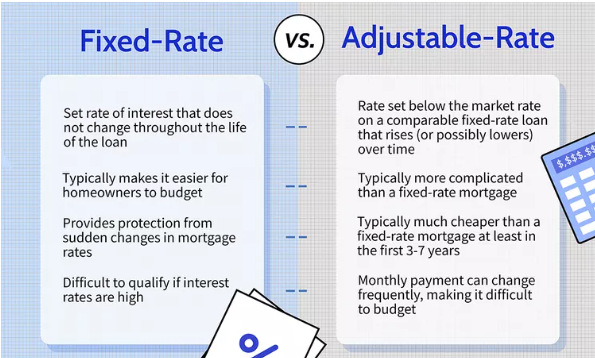

When it comes to choosing a mortgage, one of the first and most important decisions you’ll face is whether to go with a fixed-rate or an adjustable-rate mortgage (ARM). Each type has its own set of advantages and potential drawbacks, depending on your financial situation, goals, and how long you plan to stay in the home.

In this post, we’ll break down the differences between fixed and adjustable-rate mortgages to help you make a more informed choice.

What Is a Fixed-Rate Mortgage?

A fixed-rate mortgage has an interest rate that stays the same for the entire life of the loan. This means your monthly principal and interest payments remain consistent, making it easier to budget.

✅ Pros of Fixed-Rate Mortgages:

-

Predictable Payments: No surprises your monthly payment stays the same.

-

Protection from Rising Rates: Even if market interest rates go up, your rate is locked in.

-

Simple to Understand: Fixed-rate loans are straightforward and less risky.

❌ Cons of Fixed-Rate Mortgages:

-

Higher Initial Rates: Compared to ARMs, the starting interest rate is usually higher.

-

Less Flexibility: If rates drop significantly, refinancing may be needed to benefit.

🔁 Common Terms:

-

15-year fixed

-

20-year fixed

-

30-year fixed (most popular)

What Is an Adjustable-Rate Mortgage (ARM)?

An adjustable-rate mortgage has an interest rate that can change periodically — usually after an initial fixed period (like 5, 7, or 10 years). After this period, the rate adjusts based on a market index, which means your monthly payments may increase or decrease over time.

✅ Pros of Adjustable-Rate Mortgages:

-

Lower Initial Rate: ARMs typically offer lower starting interest rates than fixed-rate loans.

-

Good for Short-Term Buyers: Ideal if you plan to move or refinance before the rate adjusts.

-

Potential for Falling Rates: Your payment could decrease if interest rates drop.

❌ Cons of Adjustable-Rate Mortgages:

-

Uncertainty: After the fixed period, your rate — and payment — could rise.

-

Complexity: ARMs often include caps, margins, and adjustment periods that can be confusing.

-

Budget Risk: If your income doesn’t grow or rates increase sharply, payments may become unaffordable.

💡 Common ARM Formats:

-

5/1 ARM: Fixed for 5 years, adjusts annually thereafter.

-

7/1 ARM: Fixed for 7 years, adjusts annually.

-

10/1 ARM: Fixed for 10 years, then adjusts.

Fixed vs. Adjustable: Which One Is Right for You?

Here’s a simple breakdown to help guide your decision:

| Scenario | Best Option |

|---|---|

| Plan to stay long-term (10+ years) | Fixed-rate mortgage |

| Expect to move or refinance in 5–7 years | Adjustable-rate mortgage |

| Prefer stable, predictable payments | Fixed-rate mortgage |

| Comfortable with some risk to save money | Adjustable-rate mortgage |

Final Thoughts

Choosing between a fixed and adjustable-rate mortgage depends on your personal goals, risk tolerance, and how long you plan to own the home. Fixed-rate mortgages offer peace of mind and stability, while adjustable-rate loans may offer initial savings — but with more uncertainty later on.

Before deciding, talk to a mortgage advisor or lender who can walk you through your options and help match you with the loan that best fits your financial life.