Top 10 Loan Terms Every Borrower Should Know

Applying for a loan can be confusing especially when you’re bombarded with financial jargon. Whether you’re borrowing for a home, car, business, or personal needs, understanding key loan terms will help you make smarter decisions and avoid costly mistakes.

In this post, we’ll break down the top 10 loan terms every borrower should know so you can read loan agreements and compare offers with confidence.

1. Principal

The principal is the original amount of money you borrow from a lender. For example, if you take out a $15,000 personal loan, that $15,000 is your principal. As you make payments, a portion goes toward reducing the principal, while the rest covers interest and any applicable fees.

2. Interest Rate

The interest rate is the cost of borrowing money, expressed as a percentage of the principal. For instance, a 6% interest rate on a $10,000 loan means you’ll pay $600 per year in interest (before factoring in compounding or fees). Lower rates mean less you’ll pay over time.

3. APR (Annual Percentage Rate)

APR stands for Annual Percentage Rate. It includes the interest rate plus any additional fees, like loan origination charges. APR gives you a clearer picture of the total cost of the loan over a year and is essential for comparing loan offers apples-to-apples.

4. Term (Loan Term)

The loan term is the length of time you have to repay the loan. Terms can range from a few months (for payday or short-term loans) to 30 years (for mortgages). A longer term often means lower monthly payments but more interest paid over time.

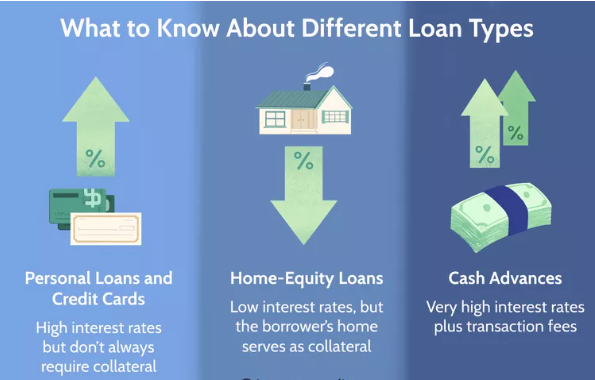

5. Collateral

Collateral is an asset (like your home, car, or savings) pledged to secure a loan. If you fail to repay, the lender can seize the collateral to recover their money. Secured loans (like mortgages and auto loans) require collateral; unsecured loans (like most personal loans) do not.

6. Amortization

Amortization is the process of gradually repaying a loan through regular payments that cover both principal and interest. Most fixed-rate loans follow an amortization schedule, which shows how much of each payment goes toward interest versus reducing the principal.

7. Debt-to-Income Ratio (DTI)

Your DTI ratio compares your monthly debt payments to your gross monthly income. Lenders use this to assess your ability to take on additional debt. A lower DTI (generally under 36%) increases your chances of loan approval.

Formula:DTI = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

8. Prepayment Penalty

Some lenders charge a prepayment penalty if you pay off your loan early. This fee compensates them for lost interest. Always check for this clause in your loan agreement especially if you plan to pay the loan off ahead of schedule.

9. Origination Fee: Top 10 Loan Terms Every Borrower Should Know

An origination fee is a one-time charge by the lender to process your loan application, usually calculated as a percentage of the loan amount (e.g., 1%–5%). It’s typically deducted from the disbursed amount, so a $10,000 loan with a 3% origination fee gives you $9,700 upfront.

10. Default: Top 10 Loan Terms Every Borrower Should Know

Default occurs when you fail to meet the terms of your loan agreement—usually by missing multiple payments. Defaulting can severely damage your credit, result in late fees, and lead to legal action or loss of collateral in secured loans.

✅ Final Thoughts on Top 10 Loan Terms Every Borrower Should Know

Loan terms don’t have to be intimidating. By familiarizing yourself with these key concepts, you’ll be empowered to:

-

Ask the right questions

-

Compare loan offers more accurately

-

Avoid surprises or hidden costs

-

Make informed decisions with your financial future in mind

Before signing any loan agreement, make sure you understand all terms and conditions and don’t hesitate to ask your lender to explain anything unclear.