The Role of Dividends in Wealth Building

When most people think of investing, they picture stock prices rising and making a profit by selling high. But there’s another powerful force behind wealth creation in the stock market: shares.

Dividends are more than just small cash payments they can be a steady stream of income, a reinvestment opportunity, and a cornerstone of a long-term wealth-building strategy.

In this post, we’ll break down what shares are, why they matter, and how you can use them to build lasting wealth.

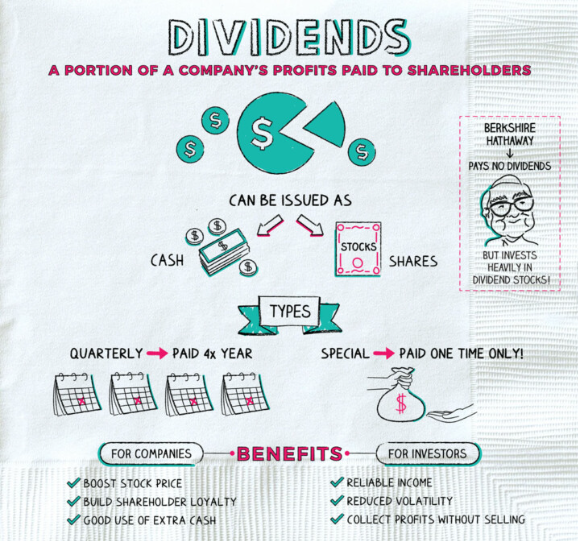

What Are Dividends?

shares are payments made by a company to its shareholders, usually from its profits. They’re typically paid quarterly and can come in the form of:

-

Cash shares– direct payments to your brokerage account

-

Stock shares– additional shares of stock

-

Special shares– one-time payments, often after windfalls

Not all companies pay dividends those that do are often well-established firms with strong cash flow (think Coca-Cola, Johnson & Johnson, or Procter & Gamble).

How Dividends Contribute to Wealth Building

1. Reliable Income Stream

Dividend-paying stocks offer consistent, passive income. This is particularly appealing for:

-

Retirees seeking regular income

-

Investors looking for stability in volatile markets

-

Anyone who wants their money to work for them

Even when markets are down, a steady dividend can cushion the blow and keep your portfolio productive.

2. Dividend Reinvestment = Compound Growth

When you reinvest your shares buying more shares instead of cashing out you trigger the magic of compound interest.

More shares = more dividends = more reinvestment = exponential growth.

Example: If you invested $10,000 in a dividend stock yielding 4% and reinvested the dividends annually, your investment could grow to over $48,000 in 30 years without adding another dollar.

3. Total Return Booster

Your investment return isn’t just about price appreciation. It’s the total return, which includes both:

-

Capital gains (share price increases)

-

shares income

A stock that grows 5% annually and pays a 3% dividend has an 8% total return (before taxes and inflation). Over decades, this added income makes a huge difference.

4. Stability in Uncertain Markets

shares -paying companies are often more stable and less volatile than high-growth, non-dividend companies. They tend to have:

-

Strong cash flow

-

Consistent earnings

-

Long-term business models

This makes them a defensive asset during downturns.

🔍 What to Look for in shares Stocks

Not all dividends are created equal. Here are a few key factors to evaluate:

-

shares Yield: This is the annual dividend as a percentage of the share price. A higher yield isn’t always better watch for sustainability.

-

Payout Ratio: The percentage of earnings paid as dividends. A healthy ratio (usually under 60%) suggests the company can maintain or grow payouts.

-

Dividend Growth: Companies that consistently raise dividends show strong financial health and commitment to shareholders.

-

Company Fundamentals: Look for solid earnings, manageable debt, and competitive advantages.

Avoid “dividend traps” stocks with unusually high yields that may not be sustainable.

Popular Shares Strategies

Shares Growth Investing

Focuses on companies that regularly increase their over time. These are often called “shares Aristocrats” companies that have increased dividends for 25+ years.

High-Yield Investing

Targets stocks or funds with above-average dividend yields, ideal for generating maximum income—but with more risk.

🟢 Dividend ETFs and Funds

If you want diversification and professional management, consider dividend-focused mutual funds or ETFs like:

-

Vanguard Dividend Appreciation ETF (VIG)

-

Schwab U.S. Dividend Equity ETF (SCHD)

-

iShares Select Dividend ETF (DVY)

💼 Real-Life Example: Building Wealth with Dividends

Imagine this:

-

You invest $5,000 each year in dividend stocks with an average yield of 3.5%.

-

You reinvest all dividends and earn an annual return of 8% (dividends + growth).

-

After 30 years, you’ll have nearly $620,000.

The consistent reinvestment and compounding dividends turn modest contributions into substantial wealth.

✅ Final Thoughts

Dividends are a quiet but powerful way to build wealth. They offer steady income, compound growth, and long-term portfolio stability—especially when reinvested.

Whether you’re investing for retirement, building a passive income stream, or just starting your journey, dividend investing can be a key pillar of financial success.