Student Loans 101: Federal vs. Private Loans

For many students, getting a degree means taking on a loan but not all student loans are created equal.

Before you sign on the dotted line, it’s essential to understand the two main types of student loans: federal and private.

Each comes with its own rules, benefits, and potential pitfalls.

1. What Are Federal Student Loans?

Federal student loans are funded by the U.S. Department of Education.

They’re designed to make higher education more accessible and usually come with borrower-friendly terms.

Key Features:

-

Fixed interest rates set by the government

-

Flexible repayment plans, including income-driven options

-

Deferment and forbearance during financial hardship

-

Loan forgiveness programs for certain public service careers

Types of Federal Loans:

-

Direct Subsidized Loans – For undergraduate students with financial need; the government pays the interest while you’re in school.

-

Direct Unsubsidized Loans – Available to most students; you’re responsible for interest from day one.

-

Direct PLUS Loans – For graduate students or parents of undergraduates; require a credit check.

Best for:

Students seeking predictable terms, flexible repayment, and possible forgiveness options.

2. What Are Private Student Loans?

Private student loans are issued by banks, credit unions, and online lenders—not the government.

Terms vary by lender, and approval depends heavily on your credit score (or your co-signer’s).

Key Features:

-

Variable or fixed interest rates (often higher for those with poor credit)

-

Fewer repayment options—usually no income-driven plans

-

Limited or no forgiveness programs

-

May require a co-signer if you have little credit history

Best for:

Students who have exhausted federal aid but still need additional funding, and who have excellent credit (or a creditworthy co-signer) to secure low rates.

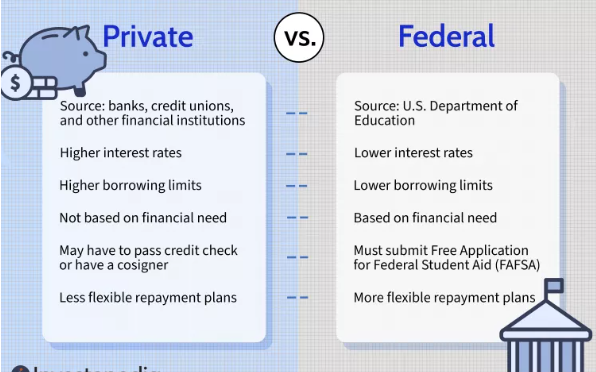

3. Federal vs. Private Loans: Side-by-Side Comparison

| Feature | Federal Loans | Private Loans |

|---|---|---|

| Interest Rates | Fixed, set by law | Fixed or variable, based on credit |

| Repayment Plans | Multiple options, including income-driven | Limited, often fixed term |

| Forgiveness Programs | Yes (Public Service Loan Forgiveness, Teacher Loan Forgiveness, etc.) | No |

| Credit Check | Not required for most loans | Usually required |

| Payment While in School | Often deferred until after graduation | May require immediate payments |

4. Which Should You Choose?

The general rule:

💡 Max out federal loans first before considering private loans.

Federal loans offer more safety nets, especially if your career path or income is uncertain.

Private loans should be a last resort—used only after you’ve explored scholarships, grants, work-study, and federal aid.

5. Tips for Borrowing Smart

-

Borrow only what you truly need—future you will thank you.

-

Compare interest rates and repayment terms carefully.

-

Understand the impact on your debt-to-income ratio after graduation.

-

Start making interest payments early if possible to reduce your total cost.

Bottom Line

Federal student loans generally provide better protection, lower interest rates, and more repayment flexibility.

Private loans can fill funding gaps, but they carry more risk—so approach with caution.

In 2025’s higher-interest environment, being strategic about which loans you take (and how much you borrow) could save you thousands of dollars in the long run.