Small Business Loans: Types, Requirements, and Where to Apply

Starting or growing a small business often requires more than just passion you need capital.

That’s where small business loans come in. Whether you’re buying equipment, expanding, or managing cash flow, the right financing can make all the difference.

In this guide, we’ll break down the main types of small business loans, what you’ll need to qualify, and the best places to apply.

Types of Small Business Loans

1. Term Loans

-

How it works: Borrow a lump sum and repay it over a set period with fixed or variable interest.

-

Best for: Large purchases, business expansion, or refinancing debt.

-

Pros: Predictable payments, flexible terms.

-

Cons: May require strong credit and collateral.

2. SBA Loans

-

Backed by: The U.S. Small Business Administration (SBA).

-

Popular Programs: SBA 7(a), SBA 504, and SBA Microloans.

-

Best for: Businesses seeking lower interest rates and longer repayment terms.

-

Pros: Low rates, long terms, smaller down payments.

-

Cons: Lengthy application process, strict requirements.

3. Business Lines of Credit

-

How it works: Access funds as needed, up to a credit limit—similar to a credit card.

-

Best for: Ongoing expenses, emergencies, or managing seasonal cash flow.

-

Pros: Pay interest only on what you use.

-

Cons: May have variable interest rates.

4. Equipment Financing

-

How it works: Loan specifically for purchasing equipment, with the equipment as collateral.

-

Best for: Buying or upgrading machinery, vehicles, or technology.

-

Pros: Easier approval, preserves cash flow.

-

Cons: Limited to equipment purchases.

5. Invoice Financing

-

How it works: Borrow against unpaid invoices to improve cash flow.

-

Best for: Businesses with long payment cycles.

-

Pros: Quick access to cash.

-

Cons: Fees can be high if invoices take long to collect.

6. Microloans

-

Loan size: Typically under $50,000.

-

Best for: Startups or very small businesses.

-

Pros: Easier to qualify for, supportive programs available.

-

Cons: Smaller loan amounts.

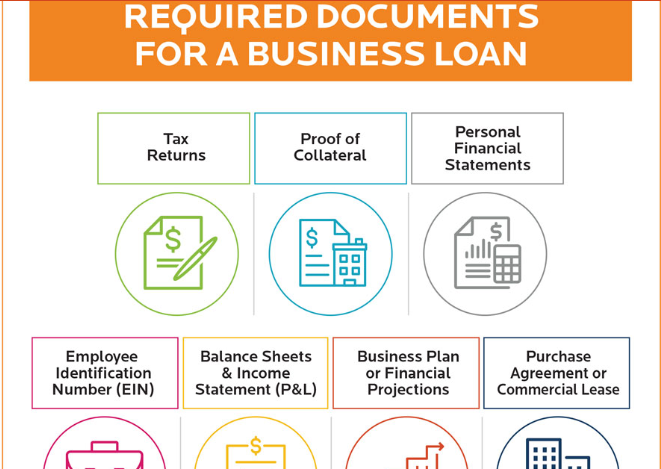

Requirements to Qualify

While requirements vary by lender and loan type, here are the common factors lenders look at:

-

Credit Score – Personal and/or business credit history.

-

Business Plan – Demonstrating viability and growth potential.

-

Revenue & Financial Statements – Proof your business can repay the loan.

-

Time in Business – Many lenders prefer 1–2 years in operation.

-

Collateral – Some loans require assets to secure the loan.

💡 Tip: Even if your credit isn’t perfect, alternative lenders and microloan programs may still be options.

Where to Apply for Small Business Loans

-

Traditional Banks: Best for established businesses with strong credit.

-

Credit Unions: Often offer competitive rates for members.

-

SBA Lenders: Banks and credit unions authorized to issue SBA-backed loans.

-

Online Lenders: Faster approvals, flexible requirements.

-

Community Development Financial Institutions (CDFIs): Support underserved businesses.

-

Peer-to-Peer Lending Platforms: Borrow directly from individual investors.

Bottom Line

The best small business loan depends on how much you need, how fast you need it, and your current financial standing.

If you have time and strong credit, SBA and bank loans offer the lowest costs. If speed matters, online lenders and lines of credit can provide quick funding.