Should You Use a Mortgage Broker or Go Direct?

When you’re ready to buy a home or refinance your mortgage, one of the first decisions you’ll face is how to secure financing. Should you go directly to a bank or lender, or work with a mortgage broker who can shop the market for you?

Both options have pros and cons. The right choice depends on your financial situation, how much time you want to invest, and how comfortable you are navigating mortgage offers.

Let’s break it down so you can decide what works best for you.

What Is a Mortgage Broker?

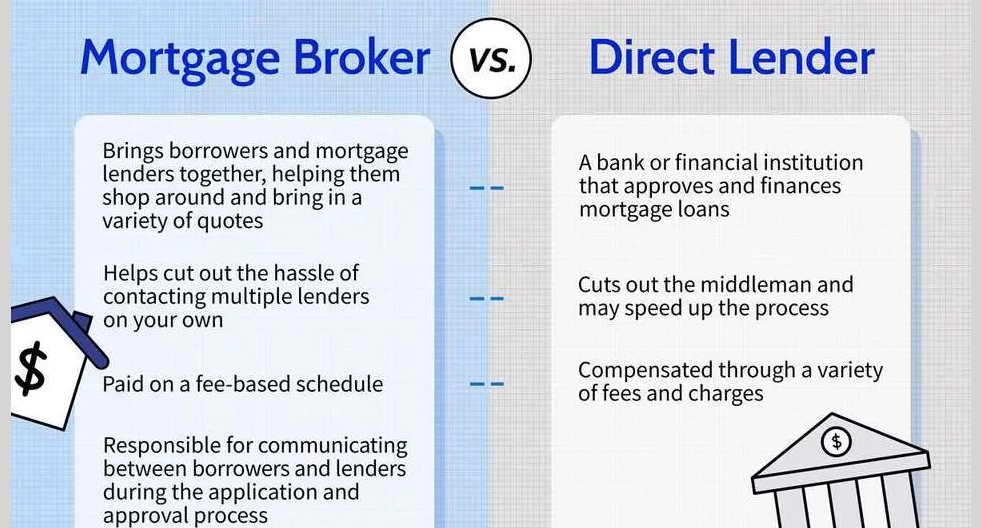

A mortgage broker is a licensed professional who acts as a middleman between you and various lenders. They assess your financial situation, gather your documents, and then shop multiple lenders to find a mortgage product that suits your needs.

Think of a broker as your personal mortgage matchmaker.

What Does It Mean to Go Direct?

Going direct means working straight with a bank, credit union, or online lender. You’ll handle the application process yourself, compare rates across a few institutions, and work with a loan officer from that specific lender.

✅ Pros of Using a Mortgage Broker

1. Access to More Lenders

Brokers work with a wide range of lenders — including ones you may not have heard of or have access to on your own. This can help you find better rates or products, especially if you have unique financial circumstances.

2. Time-Saving

Rather than applying with multiple lenders yourself, the broker does the legwork saving you hours of phone calls and paperwork.

3. Expert Advice

Brokers often know which lenders are more flexible or likely to approve your application, especially if you’re self-employed, have a lower credit score, or need a specialized loan.

4. Negotiation Power

They may be able to negotiate lower rates or better terms, especially if they have strong relationships with lenders.

❌ Cons of Using a Mortgage Broker

1. Broker Fees

Some brokers charge fees, while others are paid by lenders via commissions. This can sometimes affect the objectivity of their advice though reputable brokers are upfront about their compensation.

2. Less Control

You’re not directly managing your application, which can lead to communication delays or misunderstandings if the broker isn’t highly responsive.

3. Not All Lenders Use Brokers

Some major banks and credit unions only offer loans directly so you may miss out on those rates or deals unless you apply independently.

✅ Pros of Going Direct

1. Potentially Lower Fees

Going direct can save you from paying broker fees. Some lenders also offer special rate discounts or perks for direct applicants.

2. Direct Communication

You’ll be in control of your application, allowing you to speak directly with underwriters, loan officers, and support teams.

3. Familiarity

If you already bank with a lender, you may prefer working with a familiar institution that already knows your financial profile.

❌ Cons of Going Direct

1. Limited Options

You’ll only be offered the mortgage products from that lender. Without shopping around, you might miss better rates elsewhere.

2. Time-Consuming

Researching lenders, comparing rates, and filling out multiple applications on your own can be overwhelming especially for first-time buyers.

3. Less Flexibility

Some lenders have stricter approval guidelines or may be less willing to work with borrowers who have irregular income or lower credit.

So, Which Option Is Right for You?

| Situation | Best Option |

|---|---|

| First-time buyer needing guidance | Mortgage broker |

| Complex financial profile (e.g., self-employed) | Mortgage broker |

| You want the lowest rate and can shop around | Go direct (or use both) |

| You’re loyal to your bank and trust them | Go direct |

| You want to save time and compare multiple lenders easily | Mortgage broker |

Final Thoughts

There’s no one-size-fits-all answer when choosing between a mortgage broker and going direct. It often comes down to how much help you want, how confident you are in comparing offers, and your personal financial situation.

Pro Tip: You can even do both consult a broker and check with a few direct lenders to see who offers the best deal. A little comparison can lead to big savings over the life of your loan.