Secured vs. Unsecured Loans: What’s the Difference?

When you’re exploring borrowing options, one of the most important distinctions you’ll encounter is between secured and unsecured loans. These two loan types can affect your interest rate, approval chances, repayment terms, and even your risk of losing assets.

In this post, we’ll break down what secured and unsecured loans are, how they work, and which one might be right for your financial situation.

What Is a Secured Loan?

A secured loan is backed by collateral something valuable that the lender can claim if you default on the loan.

Examples of Secured Loans:

-

Mortgage – Your house is the collateral.

-

Auto Loan – The car being purchased secures the loan.

-

Home Equity Loan – Uses the equity in your home as collateral.

-

Secured Personal Loan – Sometimes backed by savings or a certificate of deposit (CD).

✅ Pros of Secured Loans:

-

Lower interest rates due to reduced risk for the lender

-

Easier approval, especially for borrowers with lower credit scores

-

Higher borrowing limits

Cons of Secured Loans:

-

You risk losing your collateral if you can’t repay

-

Longer application processes (especially for mortgages)

-

May require home/property appraisals or insurance

What Is an Unsecured Loan?

An unsecured loan does not require collateral. Instead, approval is based on your creditworthiness, including your credit score, income, and financial history.

Examples of Unsecured Loans:

-

Personal Loans

-

Credit Cards

-

Student Loans (most federal loans)

-

Lines of Credit (unsecured)

✅ Pros of Unsecured Loans:

-

No risk of losing your personal property

-

Faster approval and disbursement

-

Simpler application process

Cons of Unsecured Loans:

-

Higher interest rates

-

Lower borrowing limits

-

Harder to qualify with poor or limited credit

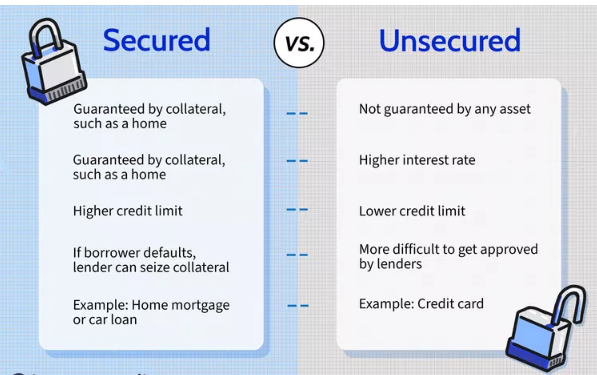

Comparison at a Glance

| Feature | Secured Loan | Unsecured Loan |

|---|---|---|

| Collateral Required | Yes | No |

| Interest Rates | Lower | Higher |

| Risk to Borrower | Loss of asset if you default | Potential legal/credit consequences |

| Credit Requirement | More flexible | Usually stricter |

| Loan Amount | Higher | Lower |

| Approval Speed | May take longer | Often faster |

Which Loan Type Should You Choose?

It depends on your financial situation, goals, and risk tolerance.

-

Choose a secured loan if:

-

You want a lower interest rate.

-

You have valuable collateral and a reliable repayment plan.

-

You’re looking to borrow a large amount (e.g., home or car purchase).

-

-

Choose an unsecured loan if:

-

You don’t want to put your assets at risk.

-

You have strong credit and need quick access to funds.

-

You’re borrowing a smaller amount or consolidating debt.

-

✅ Key Takeaways

-

Secured loans require collateral but usually offer better rates and higher loan amounts.

-

Unsecured loans rely on your credit and come with more risk for lenders (and higher costs).

-

Always assess your ability to repay and read the terms carefully before taking on any debt.