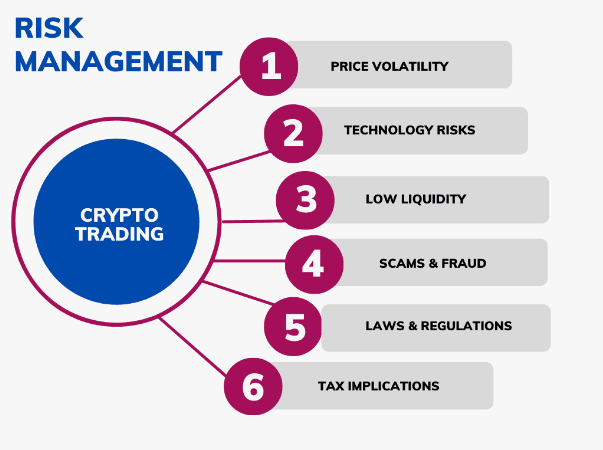

Risks of Cryptocurrency: Volatility, Hacks & More

Cryptocurrency offers exciting opportunities financial freedom, decentralization, and access to emerging digital economies. But it’s not without real risks.

Whether you’re a casual investor, an enthusiastic trader, or a curious newcomer, it’s crucial to understand the dangers involved in crypto so you can make smart, informed decisions.

In this post, we’ll break down the biggest risks in the crypto world, including price volatility, security threats, scams, and regulatory uncertainty and share tips on how to protect yourself.

1. Price Volatility: The Double-Edged Sword

Cryptocurrencies are famously volatile prices can soar or crash within hours.

Why It Happens:

-

Speculation drives most of the market activity.

-

Low liquidity compared to traditional markets.

-

Market sentiment changes rapidly with news and social media.

-

Lack of regulation allows price manipulation (“pump and dump” schemes).

📊 Example:

Bitcoin dropped from ~$69,000 in late 2021 to below $20,000 in 2022 — a massive decline that wiped out billions in investor value.

✅ How to Mitigate It:

-

Don’t invest more than you can afford to lose.

-

Use stop-loss and take-profit orders when trading.

-

Diversify your portfolio with stablecoins or less volatile assets.

-

Avoid emotional trading based on hype or fear.

2. Hacks and Cybersecurity Threats

The crypto space is a prime target for hackers due to its irreversible nature and lack of centralized protection.

Common Threats:

-

Exchange hacks (e.g., Mt. Gox, Bitfinex, FTX collapse)

-

Wallet breaches and seed phrase theft

-

DeFi protocol vulnerabilities (smart contract bugs)

-

Phishing attacks posing as legit platforms or influencers

How to Stay Safe:

-

Use hardware wallets or trusted non-custodial wallets.

-

Enable 2FA and strong passwords on all accounts.

-

Double-check URLs and never share private keys or seed phrases.

-

Keep software up to date and avoid shady platforms.

3. Scams and Fraud

Crypto’s decentralized nature and lack of oversight make it ripe for scams.

Types of Scams:

-

Ponzi schemes promising high returns (e.g., BitConnect)

-

Rug pulls in DeFi projects and meme coins

-

Fake airdrops and giveaways on social media

-

Impersonation scams (e.g., fake Elon Musk crypto offers)

Red Flags:

-

Guaranteed profits or “too good to be true” promises

-

Pressure to invest quickly

-

Anonymous teams or no whitepaper

-

Lack of transparency in project roadmaps

Prevention Tips:

-

Always DYOR (Do Your Own Research)

-

Use platforms with strong reputations

-

Avoid clicking on unsolicited links

-

Verify team credentials and audit reports

4. Regulatory Risks

Crypto laws vary widely between countries and they’re always changing.

Current Landscape:

-

Some countries ban crypto outright (e.g., China).

-

Others regulate it as property, currency, or securities.

-

Taxation rules can differ, even within the same region.

What It Means for You:

-

Sudden legal shifts can impact your access to platforms or funds.

-

You may owe taxes on trades or profits even if you didn’t cash out.

-

Regulation can affect token availability or project viability.

✔️ Tips:

-

Keep up with crypto regulations in your country.

-

Use KYC-compliant exchanges for better protection.

-

Record all transactions for tax and compliance purposes.

5. Technical Risks

Crypto is still emerging technology, which means it’s not perfect.

Risks Include:

-

Software bugs in wallets or smart contracts

-

Network congestion and high transaction fees

-

Protocol changes or forks affecting your assets

-

Lost access due to forgotten keys or damaged wallets

What You Can Do:

-

Back up your seed phrase in multiple secure locations.

-

Stay updated on protocol changes (especially in projects you’re invested in).

-

Test new platforms with small amounts before committing large funds.

-

Keep track of private keys there’s no “forgot password” in crypto.

6. Liquidity Risk

Some crypto tokens have low trading volume, meaning you may struggle to buy or sell quickly without moving the price significantly.

Especially Risky With:

-

New, unknown altcoins

-

Meme tokens or low-cap DeFi projects

What to Do: Risks of Cryptocurrency: Volatility, Hacks & More

-

Check trading volume before investing.

-

Stick with high-liquidity coins for better price stability.

-

Be cautious of tokens only listed on obscure or offshore exchanges.

Final Thoughts: Risks of Cryptocurrency: Volatility, Hacks & More

Risk is part of the crypto game but it doesn’t mean you should stay out entirely. Instead, educate yourself, take precautions, and invest responsibly.

Cryptocurrency offers the possibility of innovation and financial empowerment but only if you approach it with knowledge and caution.