Personal Loan vs. Credit Card: Which Is Better for You?

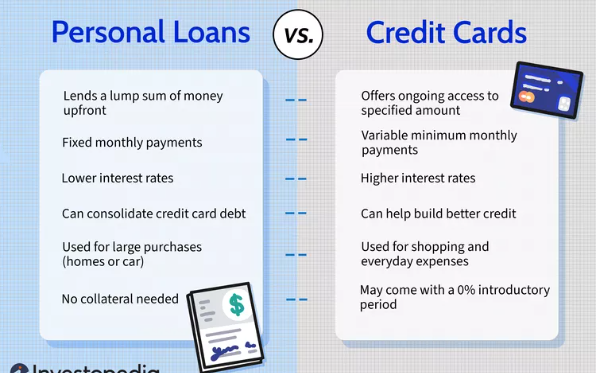

When you’re in need of extra cash whether for an emergency, a large purchase, or debt consolidation you’re likely to consider either a personal loan or a credit card. Both can give you access to funds quickly, but they serve different purposes and come with unique pros and cons.

So how do you decide which is better for your situation?

In this post, we’ll compare personal loans vs. credit cards, breaking down how they work, their advantages and disadvantages, and when to use each one.

What Is a Credit Card?

A credit card is a revolving line of credit that allows you to borrow money up to a set limit. You can borrow, repay, and borrow again without reapplying as long as you stay within your credit limit.

Key features:

-

Credit limits vary by your creditworthiness

-

Interest is charged on unpaid balances (often high)

-

Minimum payments required monthly

-

May offer rewards or cashback

What Is a Personal Loan?

A personal loan is a lump-sum loan that you repay in fixed monthly installments over a set period (typically 1 to 7 years). Most are unsecured, meaning no collateral is required.

Key features:

-

Fixed loan amount

-

Fixed interest rate and term

-

Predictable monthly payments

-

Used for a variety of purposes (debt consolidation, home improvement, etc.)

Personal Loan vs. Credit Card: Key Differences

| Feature | Personal Loan | Credit Card |

|---|---|---|

| Type of Credit | Installment loan | Revolving credit |

| Interest Rate | Lower (often fixed) | Higher (often variable) |

| Repayment Term | Fixed term (1–7 years) | No set end date |

| Loan Amount | Larger (up to $100,000 or more) | Smaller (limits vary) |

| Monthly Payments | Fixed | Variable (minimum payments required) |

| Best For | Large one-time expenses or consolidation | Small ongoing purchases or emergencies |

✅ When to Use a Personal Loan

A personal loan may be the better choice if you:

-

Need a large lump sum for a big purchase or project

-

Want to consolidate high-interest debt (e.g., multiple credit cards)

-

Prefer a fixed repayment schedule

-

Want a lower interest rate than credit cards offer

Example use cases:

-

Medical bills

-

Wedding expenses

-

Home renovations

-

Major car repairs

-

Paying off multiple high-interest debts

✅ When to Use a Credit Card

A credit card may be better if you:

-

Need to make small purchases over time

-

Want to earn rewards, points, or cashback

-

Can pay off your balance in full each month to avoid interest

-

Need a short-term emergency fund

Example use cases:

-

Everyday purchases (groceries, gas, travel)

-

Short-term cash flow gaps

-

Booking hotels or car rentals

-

Earning points for flights or rewards

What to Watch Out For

With credit cards:

-

Carrying a balance leads to high interest charges (typically 18–30% APR)

-

Only paying the minimum can trap you in long-term debt

With personal loans:

-

Some lenders charge origination fees (1%–8% of the loan)

-

Missing payments can hurt your credit score

-

Early repayment may incur prepayment penalties (check the fine print)

Can You Use Both?

Yes, in some cases it makes sense to use both—strategically.

For example:

-

Use a personal loan to consolidate credit card debt at a lower rate.

-

Use a rewards credit card for everyday purchases but pay it off monthly to avoid interest.

Final Thoughts: Which Is Better for You?

There’s no one-size-fits-all answer. It depends on your financial goals, repayment ability, and how you plan to use the funds.

Choose a personal loan if:

-

You want to borrow a fixed amount

-

You prefer predictable monthly payments

-

You’re consolidating debt or making a big purchase

Choose a credit card if:

-

You want flexibility and convenience

-

You plan to pay off purchases quickly

-

You want to earn rewards or cashback

Either way, compare rates, fees, and terms before you borrow—and always borrow responsibly.