Moving Averages in Forex : How to Trade with Them

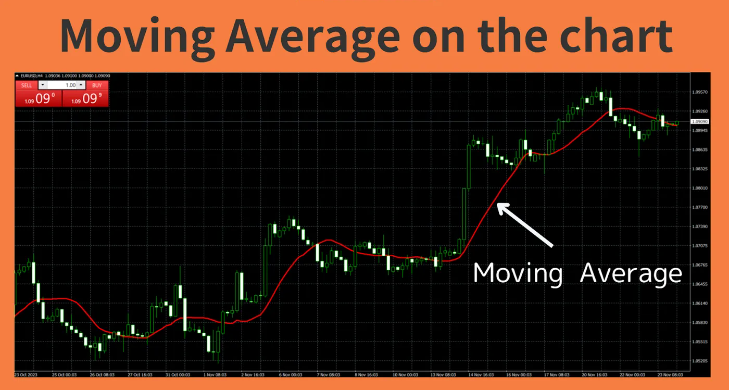

If you’ve ever looked at a forex chart, you’ve probably seen lines curving across the price candles those are moving averages. They are among the most popular and useful technical indicators in trading, and for good reason. Moving averages help traders identify the trend, smooth out market noise, and even generate buy/sell signals.

In this blog post, we’ll explain what moving averages are, the different types, and how to use them effectively in your forex trading strategy.

What is a Moving Average?

A moving average (MA) is a technical indicator that smooths out past price data to help you better understand the direction of the trend.

It does this by calculating the average closing price over a set period of time for example, 10, 20, or 50 candles.

🧠 Why Use Moving Averages in Forex?

-

✅ Identify the overall market trend

-

✅ Spot dynamic support and resistance

-

✅ Generate entry and exit signals

-

✅ Filter out market noise and avoid false signals

Moving averages are especially helpful for beginners because they make chart reading simpler and more visual.

🔄 Types of Moving Averages

There are two main types of moving averages:

1. Simple Moving Average (SMA)

-

Calculates the average of closing prices over a set number of periods.

-

Each period is weighted equally.

-

Good for identifying long-term trends.

Example: A 50-day SMA adds up the last 50 closing prices and divides by 50.

2. Exponential Moving Average (EMA)

-

Gives more weight to recent prices, making it more responsive to new data.

-

Better for short-term trading and faster signals.

Example: The 20 EMA reacts more quickly to price changes than the 20 SMA.

📈 Popular Moving Averages in Forex

| MA Type | Period | Best For |

|---|---|---|

| 20 EMA | Short-term | Scalping, intraday trades |

| 50 SMA | Medium-term | Swing trading, trend spotting |

| 200 SMA | Long-term | Overall market direction |

Many traders use two or more moving averages together to create strategies.

🧭 How to Trade Forex Using Moving Averages

Let’s look at three beginner-friendly strategies using MAs:

✅ Strategy 1: Trend Direction with One Moving Average

Use a single moving average (e.g., 50 SMA or 200 SMA) to determine trend direction.

-

If price is above the MA → Uptrend → Look for buy setups.

-

If price is below the MA → Downtrend → Look for sell setups.

Pro Tip: Combine this with candlestick signals or support/resistance for better entries.

✅ Strategy 2: Moving Average Crossover

Use two MAs to identify trend changes.

Common Pair: 50 EMA (slow) and 20 EMA (fast)

-

Bullish Signal: Fast MA crosses above slow MA → Buy

-

Bearish Signal: Fast MA crosses below slow MA → Sell

This strategy works well in trending markets but may produce false signals in sideways markets.

✅ Strategy 3: Dynamic Support and Resistance

Moving averages can act as support or resistance zones:

-

In an uptrend, the price often bounces off the moving average (support).

-

In a downtrend, the price often rejects the moving average (resistance).

You can enter trades when price tests and reacts to these levels with confirmation candles (e.g., pin bar, engulfing pattern).

📉 Example Trade Setup Using Moving Averages

-

Add the 50 EMA and 200 EMA to your chart.

-

Wait for the 50 EMA to cross above the 200 EMA (golden cross).

-

Price should be above both EMAs — this confirms a strong uptrend.

-

Wait for a pullback to the 50 EMA.

-

Look for a bullish candlestick pattern to enter the trade.

-

Place stop-loss below the recent swing low and set your take profit based on a 1:2 or 1:3 risk/reward ratio.

🛑 Mistakes to Avoid with Moving Averages

-

❌ Relying on MAs alone without price action confirmation

-

❌ Using too many MAs and overcomplicating your chart

-

❌ Ignoring sideways or ranging markets (MAs lose reliability here)

-

❌ Forgetting to manage risk — no indicator is 100% accurate

✅ Final Thoughts

Moving averages are simple but powerful tools that can guide your trading decisions and help you stay aligned with the trend. Whether you’re looking to identify market direction, time your entries, or manage your trades, MAs offer a reliable foundation for any forex trading strategy.

As a beginner, start with:

-

50 EMA for trend direction

-

20 EMA and 50 EMA crossover for entries

-

Practice identifying MA bounces on a demo account