Is Travel Insurance Worth It? When You Should Definitely Get It

We’ve all been there bags packed, tickets booked, itinerary set. But just as you’re about to take off on your dream vacation or important business trip, something unexpected happens. A missed flight. A lost bag. A sudden illness. That’s when travel insurance can be your saving grace.

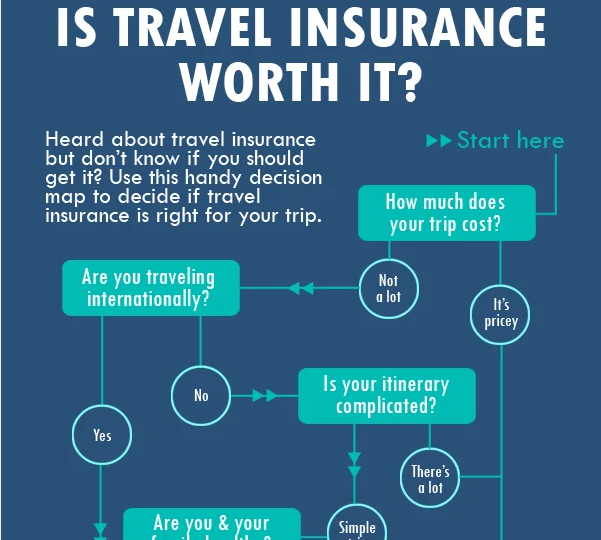

But is travel insurance always necessary? And when is it absolutely worth getting?

Let’s explore what travel insurance covers, when it’s most valuable, and how to decide if it’s right for your trip.

What Is Travel Insurance?

Travel insurance is a type of coverage that protects you financially against unexpected events before or during a trip. Depending on the policy, it can cover:

-

Trip cancellations or interruptions

-

Medical emergencies abroad

-

Lost, stolen, or delayed baggage

-

Flight delays or missed connections

-

Emergency evacuation or repatriation

-

24/7 travel assistance services

Some policies even cover things like rental car damage or identity theft.

💡 Is Travel Insurance Always Worth It?

The short answer is: not always—but in many cases, it can be a smart investment.

If you’re taking a quick domestic trip with minimal expenses, it may not be necessary. However, if your trip involves high costs, international travel, or potential risks, travel insurance could save you thousands.

Let’s look at specific situations where it’s definitely worth considering.

✅ When You Should Definitely Get Travel Insurance

1. International Travel

Healthcare abroad can be expensive, and many countries won’t accept your domestic health insurance. Travel insurance with medical coverage can help cover hospital stays, doctor visits, and emergency evacuations.

Example: A broken leg while skiing in Switzerland could cost over $10,000 without coverage.

2. Non-Refundable Expenses

If your trip includes prepaid, non-refundable bookings like flights, hotels, tours, or cruises, travel insurance can reimburse you if you have to cancel for a covered reason (like illness, injury, or family emergency).

Tip: Look for Trip Cancellation and Trip Interruption coverage.

3. Adventure or Remote Travel

Planning to hike in the Andes or go scuba diving in Thailand? Travel insurance is a must. Not only can it cover risky activities (depending on the policy), but it also provides emergency evacuation if you’re in a remote area.

4. Unstable Travel Conditions

Traveling to a destination with political unrest, natural disasters, or high COVID-19 restrictions? Insurance can help you reschedule, cancel, or get support if things go sideways.

Note: Not all policies cover pandemics or civil unrest, so read the fine print.

5. You Have Health Issues

If you or a family member has a pre-existing condition, consider a plan that includes medical coverage and cancellation for medical reasons. Many insurers offer add-ons or waivers for pre-existing conditions.

6. Lost or Delayed Luggage Would Be a Big Deal

If your checked luggage contains essentials (e.g., medications, wedding attire, work equipment), baggage insurance can cover loss or delays and help you replace items quickly.

🤔 When You Might Skip It

You may not need travel insurance if:

-

You’re taking a short domestic trip with refundable reservations.

-

Your credit card already offers decent coverage.

-

You’re willing to accept the risk and can afford to lose the money spent.

💸 How Much Does It Cost?

Travel insurance usually costs between 4% and 10% of your total trip cost.

Example: For a $2,000 trip, expect to pay $80–$200 for coverage, depending on your age, destination, and the level of protection.

🧾 What to Look for in a Good Travel Insurance Plan

-

Trip Cancellation & Interruption

-

Medical & Emergency Evacuation Coverage

-

Baggage Loss/Delay Protection

-

24/7 Support Services

-

Optional add-ons (adventure sports, rental car, etc.)

Always compare providers and read the policy details to understand what is and isn’t covered.

✈️ Final Thoughts

Travel insurance isn’t glamorous, but it’s one of the smartest things you can buy for peace of mind. If your trip is expensive, international, risky, or uncertain—get covered.

Because when the unexpected happens, you’ll be glad you planned ahead.