How to Set SMART Financial Goals for Your Business

Every successful business starts with a vision but vision alone isn’t enough. To turn ideas into reality, you need clear and actionable financial goals. The problem is, many entrepreneurs set goals that are too vague, unrealistic, or hard to measure. That’s where the SMART framework comes in.

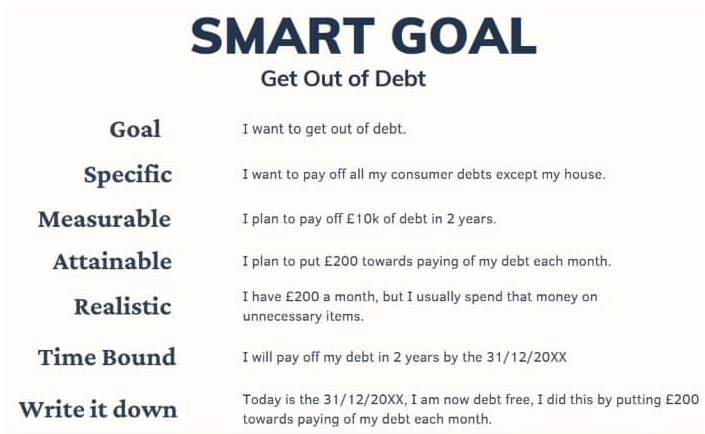

SMART goals are Specific, Measurable, Achievable, Relevant, and Time-bound. They give your business direction, keep you accountable, and help you track progress effectively.

Here’s how to apply the SMART method to your business finances.

Why Financial Goals Matter

Without clear goals, it’s easy to:

-

Overspend on things that don’t grow your business

-

Lose track of revenue targets

-

Struggle with cash flow

-

Miss opportunities to reinvest and scale

Financial goals keep your business focused, disciplined, and growth-oriented.

Breaking Down SMART Financial Goals

1. Specific

Your goals should be clear, not vague. Instead of saying, “I want to make more money,” say:

👉 “I want to increase monthly revenue from $10,000 to $15,000 by attracting 50 new clients.”

2. Measurable

You should be able to track your progress with numbers. For example:

👉 “Reduce operating expenses by 10% over the next six months.”

3. Achievable

Set goals that stretch you but are realistic. Aiming to triple your revenue in two months may sound exciting, but it could set you up for failure.

👉 “Grow sales by 20% this year by expanding into one new market.”

4. Relevant

Your goals should align with your business vision. Don’t chase trends that don’t serve your long-term growth.

👉 “Increase online sales by 30% by investing in e-commerce marketing,” if your long-term plan is to scale digitally.

5. Time-bound

Deadlines create urgency. Without them, goals drift.

👉 “Build a business emergency fund of $20,000 within 12 months.”

Examples of SMART Financial Goals for Businesses

-

Increase net profit margin from 15% to 20% within the next year.

-

Pay off $30,000 in business debt within 18 months.

-

Grow monthly recurring revenue (MRR) by 25% in the next two quarters.

-

Save 5% of monthly revenue for an emergency fund over the next 12 months.

-

Launch a new product and generate $50,000 in sales within six months.

Tips for Sticking to Your Financial Goals

-

Break Big Goals Into Smaller Milestones

For example, if your goal is $100,000 in sales this year, track it as $25,000 per quarter. -

Review Progress Regularly

Schedule monthly or quarterly check-ins to adjust strategies if you’re off track. -

Use Tools and Automation

Accounting software, dashboards, and financial apps make it easier to monitor progress. -

Celebrate Wins

Reward yourself and your team when milestones are hit—it keeps motivation high.

Final Thoughts

SMART financial goals give your business clarity and focus. They turn dreams into actionable steps and provide a roadmap for growth.

Remember: vague goals create vague results. But when you set goals that are Specific, Measurable, Achievable, Relevant, and Time-bound, you set your business up for financial success that’s both sustainable and measurable.