How to File a Claim for Property Damage (Step-by-Step Guide)

Whether it’s storm damage, a house fire, vandalism, or a burst pipe, property damage can be stressful and overwhelming. But if you’re insured, filing a claim can help you recover financially and get your life back on track.

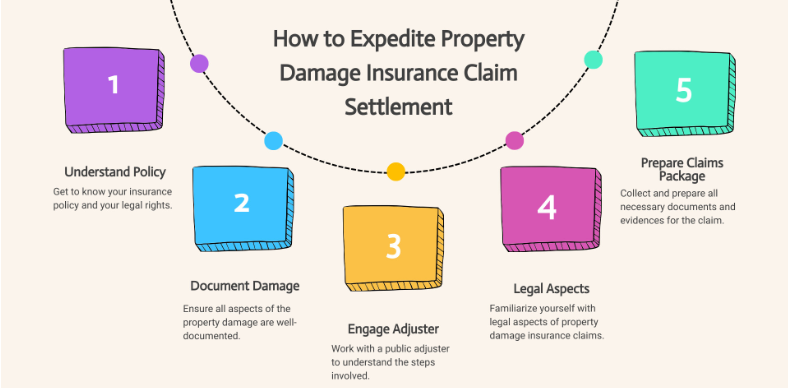

To make the process smoother and increase your chances of a successful claim, here’s a step-by-step guide on how to file a property damage insurance claim the right way.

Step 1: Assess the Damage (Safely)

Before doing anything, make sure the area is safe. If the damage was caused by fire, flood, or structural collapse:

-

Wait for emergency services to give the all-clear

-

Avoid electrical hazards or unstable structures

Then:

-

Walk through and note what’s damaged

-

Take photos and videos from multiple angles

Tip: Document before you clean or remove anything.

Step 2: Contact Your Insurance Company

Notify your insurer as soon as possible. Most policies require prompt reporting, and delays could jeopardize your claim.

When calling or filing online:

-

Have your policy number ready

-

Briefly describe what happened and the extent of the damage

-

Ask what documentation is needed

You may be assigned a claims adjuster, who will investigate your claim and determine your payout.

Step 3: Review Your Policy

Understanding what your insurance does (and doesn’t) cover will help you manage expectations.

Check:

-

Covered perils (e.g., fire, theft, wind)

-

Deductibles and coverage limits

-

Special conditions (e.g., exclusions for floods or earthquakes)

-

Time limits for repairs or replacements

Pro Tip: If you have “replacement cost coverage,” you’ll get the value to replace items—not just their depreciated worth.

Step 4: Prevent Further Damage

Most insurers require you to take reasonable steps to prevent additional loss. This may include:

-

Tarping a damaged roof

-

Boarding up broken windows

-

Turning off water or power

Keep receipts for any emergency repairs or supplies—these costs may be reimbursable.

Don’t start permanent repairs until your insurer approves them.

Step 5: Submit a Detailed Claim

Your insurer may give you a claim form or ask you to log into an online portal. Be thorough when filling it out.

Include:

-

Description of what happened

-

A list of damaged or lost items (include model numbers, brands, and purchase dates if possible)

-

Photos/videos

-

Receipts or proof of ownership (if available)

For structural damage, a contractor’s estimate can help back up your claim.

Step 6: Meet with the Claims Adjuster

The adjuster may visit your property to inspect the damage. Be prepared to:

-

Show them the affected areas

-

Provide any documentation or receipts

-

Ask questions about next steps

Tip: You can also get your own independent assessment or work with a public adjuster if you disagree with their evaluation.

Step 7: Review the Settlement Offer

Once the investigation is complete, the insurer will provide a settlement offer.

Review:

-

How much is being paid

-

What’s being covered

-

What your deductible is

-

Whether it’s actual cash value or replacement cost

If anything is unclear or seems unfair, don’t be afraid to negotiate or appeal.

Step 8: Start Repairs and Replacements

Once the claim is approved, you can begin repairs. Depending on your policy:

-

The insurer may pay you directly

-

They may pay your contractor

-

Some payouts may come in installments (e.g., partial payment upfront, balance after work is done)

Important: Keep all receipts and invoices related to the repairs.

Step 9: Keep Records of Everything: How to File a Claim for Property Damage (Step-by-Step Guide)

Throughout the entire process, keep detailed records of:

-

Conversations with your insurance company

-

Emails, letters, and claim forms

-

Receipts and invoices

-

Payments received

These documents can be crucial if disputes arise or if you need to file taxes or apply for government aid.

✅ Final Thoughts on How to File a Claim for Property Damage (Step-by-Step Guide)

Filing a property damage claim can be time-consuming, but being organized and proactive can help you avoid common pitfalls. Here’s a quick recap:

🔹 Take photos and report the damage

🔹 Contact your insurer quickly

🔹 Document everything

🔹 Work with the adjuster

🔹 Review your payout carefully