How to Dispute Errors on Your Credit Report (Step-by-Step Guide)

Your credit report plays a huge role in your financial life. It affects your ability to qualify for loans, get approved for credit cards, rent an apartment, and sometimes even land a job. That’s why it’s critical to make sure the information in your report is accurate.

Unfortunately, errors are more common than you might think. According to studies, one in five consumers has found an error on at least one of their credit reports. The good news? You have the right to dispute mistakes and get them corrected for free.

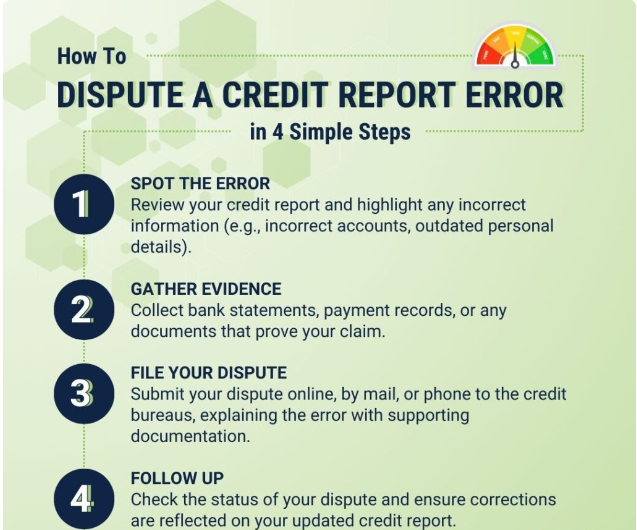

Here’s a simple step-by-step guide to disputing errors on your credit report.

Step 1: Get Your Free Credit Reports

You’re entitled to a free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion once per year at AnnualCreditReport.com.

Tip: During certain periods (like post-pandemic), the bureaus have even offered free weekly reports, so check availability.

Step 2: Review Your Reports Carefully

Look through your reports line by line. Common errors include:

-

Accounts that don’t belong to you.

-

Incorrect account status (e.g., showing late when you paid on time).

-

Wrong balance or credit limit.

-

Outdated negative items that should have fallen off.

-

Duplicate accounts listed more than once.

Highlight anything that looks suspicious or incorrect.

Step 3: Gather Supporting Documentation

You’ll need proof to back up your claim. Depending on the error, this may include:

-

Bank or credit card statements.

-

Payment confirmations.

-

Loan agreements.

-

Letters or emails from your lender.

-

Court documents (in cases of bankruptcy or legal disputes).

The stronger your evidence, the more likely your dispute will succeed.

Step 4: File a Dispute with the Credit Bureau

You can file disputes online, by phone, or by mail. Online is the fastest, but sending a written letter by certified mail gives you a paper trail.

Include the following:

-

A clear description of the error.

-

Copies (not originals) of your supporting documents.

-

A request for correction or removal.

📌 Contact info for the three major bureaus:

-

Equifax: equifax.com/personal/credit-report-services/credit-dispute

-

Experian: experian.com/disputes/main.html

-

TransUnion: transunion.com/credit-disputes

Step 5: Notify the Furnisher (the Company That Reported the Info)

It’s also smart to contact the lender, credit card company, or collection agency that reported the inaccurate information. Provide the same documentation and request they correct the error with all three bureaus.

Step 6: Wait for the Investigation

By law, the credit bureau must investigate your dispute within 30 days (45 in some cases). They’ll reach out to the furnisher, review your evidence, and make a decision.

Step 7: Review the Results

Once the investigation is complete, the bureau will send you the results in writing. If your dispute is successful:

-

The incorrect item must be corrected or removed.

-

You’ll receive a free updated copy of your credit report.

If it’s not corrected, you can request that a statement of dispute be added to your report, so future lenders know you contest the information.

Pro Tips for Successful Disputes

-

Always keep copies of letters and documents you send.

-

Be polite but firm in your communication.

-

Focus only on actual errors (not negative items that are accurate but hurt your score).

-

Check all three reports an error might appear on one but not the others.

Final Thoughts

Mistakes on your credit report can cost you in higher interest rates, loan denials, and missed opportunities. But you don’t have to live with them. By following these steps and staying organized, you can take control of your credit report and ensure it reflects your true financial history.