How Much Life Insurance Coverage Do You Actually Need?

Life insurance is one of the most important financial decisions you can make but figuring out how much coverage you actually need can feel overwhelming.

Too little coverage may leave your loved ones financially vulnerable. Too much, and you may be overpaying for protection you don’t need.

So how do you strike the right balance?

In this guide, we’ll help you determine the right amount of life insurance coverage based on your unique situation.

Why Life Insurance Matters

Life insurance provides a financial safety net for your loved ones if you pass away. It’s designed to:

-

Replace lost income

-

Cover daily living expenses

-

Pay off debts like a mortgage or student loans

-

Fund your children’s education

-

Pay for funeral and burial costs

-

Leave behind a financial legacy

But how much is enough?

🧮 Quick Answer: The “10x Rule”

A popular rule of thumb is to buy 10 times your annual income in life insurance.

📌 Example:

If you earn ₦5,000,000 per year, aim for ₦50,000,000 in coverage.

But here’s the catch: While the 10x rule is a decent starting point, it doesn’t account for individual needs like debts, number of dependents, or future goals. A more detailed approach is often better.

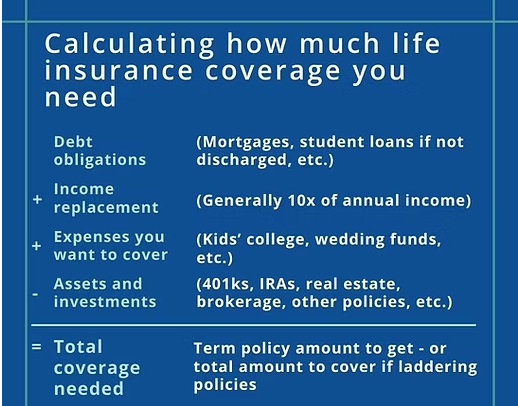

✅ Step-by-Step Guide to Calculating Your Coverage Needs

1. Calculate Your Financial Obligations

Add up all the expenses your family would need to cover in your absence:

-

Outstanding debts (e.g., mortgage, car loan, credit cards)

-

Funeral expenses (₦1M–₦3M on average)

-

Future education costs (e.g., university fees)

-

Daily living expenses (e.g., food, utilities, transportation)

-

Childcare or eldercare expenses (if applicable)

✅ Total Obligations: ₦ [Your Number]

2. Subtract Your Existing Assets

Now subtract any resources your family could use, such as:

-

Current savings

-

Investments (stocks, mutual funds)

-

Existing life insurance

-

Retirement accounts

✅ Total Assets: ₦ [Your Number]

3. Account for Lost Income Over Time

If you’re the primary earner, think about how long your family would need to replace your income. Most experts suggest:

-

5–10 years of income replacement for a basic safety net

-

Up to 20 years if you have young children or dependents

✅ Example: ₦5,000,000 income × 10 years = ₦50,000,000

4. Add It All Up

Here’s a basic formula you can use:

📊 Sample Breakdown

Let’s say you’re a 35-year-old with the following:

-

Annual income: ₦5,000,000

-

Mortgage: ₦20,000,000

-

Child education fund: ₦8,000,000

-

Funeral costs: ₦2,000,000

-

Current savings/investments: ₦10,000,000

-

Income replacement for 10 years: ₦50,000,000

Ideal coverage:

₦20M (mortgage) + ₦8M (education) + ₦2M (funeral) + ₦50M (income) – ₦10M (savings)

= ₦70,000,000 in coverage

🤔 Term vs. Whole Life: Which Affects Coverage?

Once you know how much coverage you need, you’ll need to decide between:

-

Term Life Insurance (coverage for a set period, like 10, 20, or 30 years)

-

Whole Life Insurance (permanent coverage with a savings component)

👉 Term life is usually the most affordable way to get high coverage for income replacement needs.

🔁 Reassess As Life Changes

Life insurance isn’t a “set-it-and-forget-it” decision. Revisit your coverage when you:

-

Get married or divorced

-

Have children

-

Buy a house

-

Change jobs

-

Retire

Your financial responsibilities change—and your insurance coverage should, too.

🧠 Final Thoughts

There’s no one-size-fits-all answer to how much life insurance you need. It depends on your income, debts, family situation, and future goals.