How Mortgage Interest Rates Work

When shopping for a home loan, you’ll hear a lot about mortgage interest rates and for good reason. The interest rate you get on your mortgage can have a major impact on your monthly payment, loan affordability, and long-term financial health.

But what exactly determines a mortgage interest rate? And how does it work in practice?

In this post, we’ll break down the basics of mortgage interest rates so you can make smarter, more informed decisions as a homebuyer or homeowner.

What Is a Mortgage Interest Rate?

A mortgage interest rate is the cost a lender charges you to borrow money to buy a home. It’s expressed as a percentage of your total loan amount and is applied to the principal balance of the mortgage.

For example, if you borrow $250,000 at a 6% interest rate, that 6% is what you’ll pay annually on the unpaid loan balance — on top of repaying the loan itself.

Fixed vs. Adjustable Interest Rates

There are two main types of mortgage interest rates:

✅ Fixed Interest Rate

-

Stays the same for the entire term of the loan.

-

Monthly payments are predictable.

-

Ideal for long-term homeowners who prefer stability.

🔁 Adjustable Interest Rate (ARM)

-

Starts low but can adjust periodically based on the market.

-

Payments may rise or fall over time.

-

Ideal for short-term homeowners or those expecting to refinance.

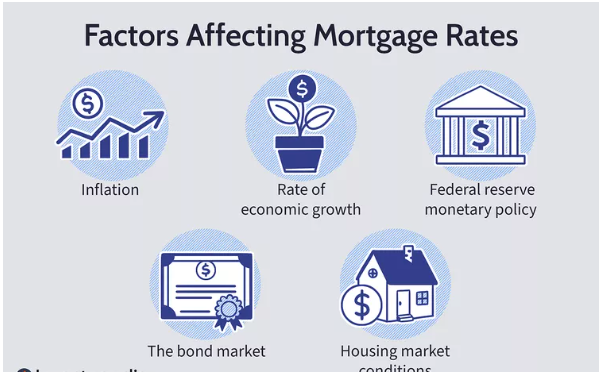

What Factors Influence Mortgage Interest Rates?

Several key factors influence the mortgage rate you’re offered:

1. Your Credit Score

-

Higher credit scores usually qualify for lower rates.

-

Lenders see low credit scores as higher risk.

2. Loan Type

-

Conventional, FHA, VA, and USDA loans may have different rate ranges.

3. Loan Term

-

Shorter-term loans (e.g., 15 years) often come with lower rates than 30-year terms.

4. Loan Amount and Down Payment

-

Larger down payments often reduce your interest rate.

-

“Jumbo” loans (larger than conforming loan limits) may have higher rates.

5. Market Conditions

-

Economic factors like inflation, the Federal Reserve’s policies, and bond markets affect rates.

6. Debt-to-Income (DTI) Ratio

-

A lower DTI signals financial stability and can improve your interest rate offer.

APR vs. Interest Rate: What’s the Difference?

-

Interest Rate = Cost of borrowing the principal loan amount.

-

APR (Annual Percentage Rate) = Interest rate plus other fees and closing costs.

APR gives you a better idea of the true cost of the mortgage over time.

Why Interest Rates Matter

Even a small difference in your mortgage rate can add up to thousands of dollars over the life of your loan.

💡 Example:

-

A $300,000 loan at 5.5% = ~$1,703/month (principal & interest)

-

The same loan at 6.5% = ~$1,896/month

➡️ That’s $193 more per month, or over $69,000 more over 30 years!

Tips to Get a Better Mortgage Rate

-

Improve Your Credit Score before applying.

-

Shop Around – Get quotes from multiple lenders.

-

Consider a Larger Down Payment.

-

Lock In Your Rate – Especially in a rising-rate market.

-

Reduce Your Debts to improve your DTI ratio.

Final Thoughts

Understanding how mortgage interest rates work can save you money and help you choose the right loan. Whether you’re a first-time buyer or refinancing, being informed about rates — and what influences them — gives you the power to negotiate smarter and avoid costly surprises.

When shopping for a home loan, you’ll hear a lot about mortgage interest rates and for good reason. The interest rate you get on your mortgage can have a major impact on your monthly payment, loan affordability, and long-term financial health.

But what exactly determines a mortgage interest rate? And how does it work in practice?

In this post, we’ll break down the basics of mortgage interest rates so you can make smarter, more informed decisions as a homebuyer or homeowner.

What Is a Mortgage Interest Rate?

A mortgage interest rate is the cost a lender charges you to borrow money to buy a home. It’s expressed as a percentage of your total loan amount and is applied to the principal balance of the mortgage.

For example, if you borrow $250,000 at a 6% interest rate, that 6% is what you’ll pay annually on the unpaid loan balance — on top of repaying the loan itself.

Fixed vs. Adjustable Interest Rates

There are two main types of mortgage interest rates:

✅ Fixed Interest Rate

-

Stays the same for the entire term of the loan.

-

Monthly payments are predictable.

-

Ideal for long-term homeowners who prefer stability.

🔁 Adjustable Interest Rate (ARM)

-

Starts low but can adjust periodically based on the market.

-

Payments may rise or fall over time.

-

Ideal for short-term homeowners or those expecting to refinance.

What Factors Influence Mortgage Interest Rates?

Several key factors influence the mortgage rate you’re offered:

1. Your Credit Score

-

Higher credit scores usually qualify for lower rates.

-

Lenders see low credit scores as higher risk.

2. Loan Type

-

Conventional, FHA, VA, and USDA loans may have different rate ranges.

3. Loan Term

-

Shorter-term loans (e.g., 15 years) often come with lower rates than 30-year terms.

4. Loan Amount and Down Payment

-

Larger down payments often reduce your interest rate.

-

“Jumbo” loans (larger than conforming loan limits) may have higher rates.

5. Market Conditions

-

Economic factors like inflation, the Federal Reserve’s policies, and bond markets affect rates.

6. Debt-to-Income (DTI) Ratio

-

A lower DTI signals financial stability and can improve your interest rate offer.

APR vs. Interest Rate: What’s the Difference?

-

Interest Rate = Cost of borrowing the principal loan amount.

-

APR (Annual Percentage Rate) = Interest rate plus other fees and closing costs.

APR gives you a better idea of the true cost of the mortgage over time.

Why Interest Rates Matter

Even a small difference in your mortgage rate can add up to thousands of dollars over the life of your loan.

💡 Example:

-

A $300,000 loan at 5.5% = ~$1,703/month (principal & interest)

-

The same loan at 6.5% = ~$1,896/month

➡️ That’s $193 more per month, or over $69,000 more over 30 years!

Tips to Get a Better Mortgage Rate

-

Improve Your Credit Score before applying.

-

Shop Around – Get quotes from multiple lenders.

-

Consider a Larger Down Payment.

-

Lock In Your Rate – Especially in a rising-rate market.

-

Reduce Your Debts to improve your DTI ratio.

Final Thoughts

Understanding how mortgage interest rates work can save you money and help you choose the right loan. Whether you’re a first-time buyer or refinancing, being informed about rates — and what influences them — gives you the power to negotiate smarter and avoid costly surprises.