How Inflation and Interest Rate Changes Affect Your Mortgage

Whether you’re buying your first home or refinancing an existing loan, economic forces like inflation and interest rate fluctuations play a major role in your mortgage experience. These two factors can influence your monthly payments, borrowing power, and even your long-term financial health.

In this blog post, we break down how inflation and interest rate changes impact your mortgage and what you can do to protect yourself.

What Is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises over time. When inflation increases, your money buys less than it did before which affects everything from groceries to housing costs.

Central banks, like the U.S. Federal Reserve or the Central Bank of Nigeria, monitor inflation closely and often adjust interest rates to try to control it.

How Interest Rates Are Connected to Inflation

When inflation rises:

-

Central banks may increase interest rates to slow down spending and borrowing.

-

When inflation is low or falling, they may cut interest rates to stimulate the economy.

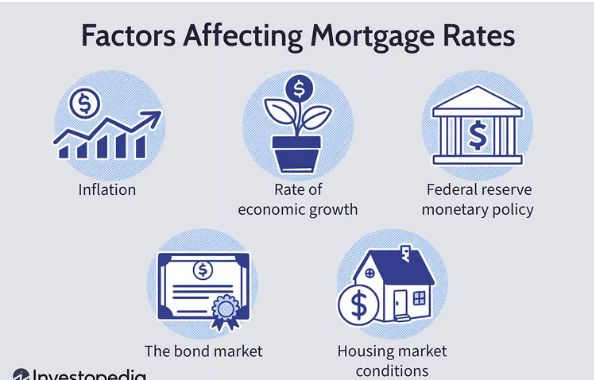

Mortgage rates tend to follow the direction of central bank rates, though they’re also influenced by market conditions, bond yields, and lender competition.

How This Affects Your Mortgage

1. When Interest Rates Rise:

If you’re looking to buy or refinance:

-

Your monthly mortgage payments will be higher, because borrowing is more expensive.

-

You may qualify for a smaller loan, reducing your home buying power.

-

Home sales might slow down, potentially softening housing prices.

If you already have a fixed-rate mortgage:

-

Your rate stays locked in, so you’re protected from increases.

-

However, inflation may impact your overall budget (utilities, groceries, etc.), making it harder to meet your payment.

If you have an adjustable-rate mortgage (ARM):

-

Your interest rate may increase at your next adjustment period, raising your monthly payments.

2. When Interest Rates Fall:

Lower rates typically:

-

Make mortgage payments more affordable, since you’re borrowing at a lower cost.

-

Increase your purchasing power you can afford more home for the same monthly payment.

-

Create opportunities to refinance at a lower rate, potentially saving thousands.

But beware: Falling rates often happen during economic downturns, so lenders may tighten requirements or delay approvals.

Real-Life Example

Let’s say you’re taking a ₦30 million mortgage for 20 years.

-

At 7% interest, your monthly principal and interest = approx. ₦232,000

-

At 10% interest, your monthly payment = approx. ₦289,000

That’s a difference of over ₦57,000 per month just due to interest rate changes!

How to Protect Yourself

-

Lock in a Fixed Rate (If Rates Are Rising)

A fixed-rate mortgage offers payment stability, especially in a rising interest rate environment. -

Get Pre-Approved Early

If you’re house-hunting, secure pre-approval so you can act fast before rates go up. -

Consider Refinancing

If rates fall significantly and you’re on a high-interest or adjustable-rate loan, refinancing can lower your costs. -

Factor in Inflation When Budgeting

Rising living costs can squeeze your budget. Don’t borrow the maximum just because a lender says you can. -

Build an Emergency Fund

This gives you a cushion if inflation drives up other household expenses.

Final Thoughts

Inflation and interest rates are part of the broader economic cycle and while you can’t control them, you can plan smartly around them. Understanding how they affect your mortgage can help you make better decisions about when to buy, refinance, or lock in your rate.

As a homeowner or homebuyer, staying informed and financially flexible is key to weathering any changes the economy brings.