How Inflation and Economic Trends Affect Loan Rates

If you’ve ever applied for a loan whether a mortgage, car loan, or personal loan you’ve probably noticed that interest rates don’t stay the same forever. They go up, they go down, and sometimes they change faster than you can say “central bank policy.”

But what drives these changes? Two of the biggest forces are inflation and broader economic trends. Understanding how they work can help you borrow smarter, lock in better rates, and avoid costly surprises.

The Inflation–Interest Rate Connection

Inflation is the rate at which prices for goods and services rise over time. Central banks, like the Federal Reserve in the U.S. or the Central Bank of Nigeria, aim to keep inflation under control usually around a target rate (often 2–3%).

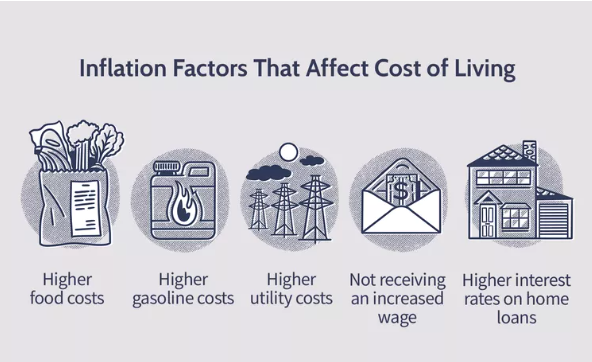

When inflation is high, central banks typically raise benchmark interest rates to slow spending and bring prices down. This increase trickles down to:

-

Higher loan rates (mortgages, personal loans, auto loans)

-

Higher credit card interest rates

-

More expensive borrowing for businesses

When inflation is low, central banks may cut rates to encourage borrowing and stimulate economic growth—leading to lower loan costs.

Key Economic Trends That Influence Loan Rates

1. Economic Growth

-

Strong growth often leads to higher demand for loans, which can push rates up.

-

Weak growth or a recession typically results in lower rates as policymakers try to stimulate the economy.

2. Employment Levels

-

High employment = more consumer spending and borrowing, which can drive rates higher.

-

High unemployment = weaker demand for loans, often leading to lower rates.

3. Global Events

Events like oil price shocks, geopolitical conflicts, or pandemics can disrupt economies, affecting both inflation and interest rate policies.

4. Government Debt Levels

Countries with high national debt may face pressure to keep rates low to manage repayment costs—though inflation can complicate this balancing act.

5. Currency Strength

A stronger currency can help keep inflation in check, sometimes leading to lower rates. A weaker currency can increase inflationary pressure, often pushing rates higher.

How This Affects You as a Borrower

If you’re planning to take out a loan:

-

When inflation is rising: Expect rates to increase. Lock in fixed rates sooner rather than later.

-

When the economy is slowing: Rates may drop, giving you a chance to refinance existing loans.

-

Watch central bank announcements: Policy decisions can signal where rates are heading next.

Practical Tips to Navigate Rate Changes

-

Consider fixed-rate loans in high-inflation environments to avoid future increases.

-

Refinance when rates are falling to reduce long-term costs.

-

Maintain strong credit—the better your score, the more favorable your rate regardless of the economy.

-

Borrow only what you need—economic uncertainty can make repayment harder if conditions change.

The Bottom Line

Inflation and economic trends are like the tides—they constantly shift, and loan rates rise or fall in response. By keeping an eye on these indicators, you can time your borrowing wisely, save money, and avoid unpleasant surprises.