How Economic News Affects Currency Markets

If you’ve ever watched the forex market spike out of nowhere and wondered what happened chances are, an economic news release just hit the wires. From jobs data to central bank announcements, economic news is one of the biggest drivers of currency prices.

Understanding how these events influence currency pairs can give you an edge as a forex trader. In this blog post, we’ll explain how economic news affects currency markets, which reports to watch, and how to trade smarter around them.

📌 Why Economic News Matters in Forex

The foreign exchange market (forex) is driven by the supply and demand for currencies, and that demand is heavily influenced by a country’s economic strength.

Economic news provides real-time insights into:

-

The health of a nation’s economy

-

Potential actions by central banks

-

Shifts in investor confidence and sentiment

When news surprises the market — either positively or negatively — currency values can swing within seconds, offering both opportunity and risk.

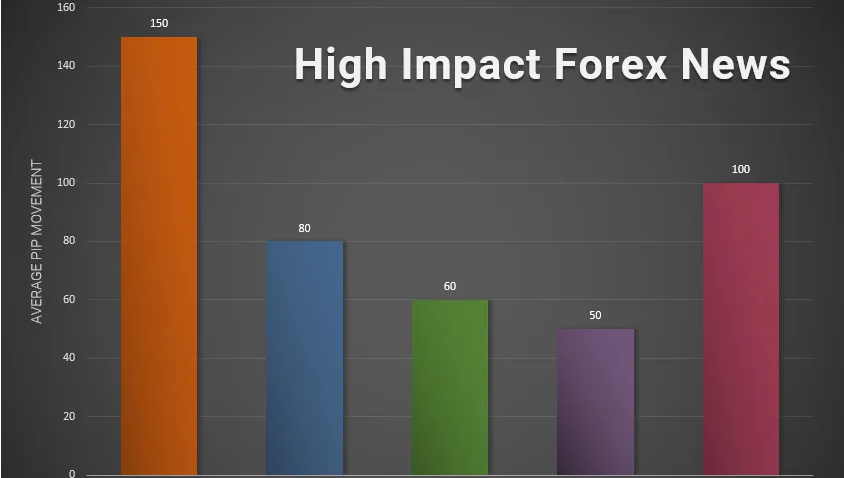

📊 Key Economic News That Moves the Market

Let’s look at some of the most important reports and announcements:

📈 1. Interest Rate Decisions

Arguably the most impactful type of news. Central banks (like the Federal Reserve or ECB) adjust interest rates to control inflation and economic growth.

-

Rate Hike (Increase) → Currency typically strengthens

-

Rate Cut (Decrease) → Currency typically weakens

-

No Change → Impact depends on expectations and guidance

💡 Example: If the U.S. Federal Reserve raises rates unexpectedly, USD usually rallies.

📊 2. Non-Farm Payrolls (NFP) – U.S. Jobs Report

Released monthly, this report shows how many jobs were added (or lost) in the U.S. (excluding farms).

-

Higher-than-expected jobs → Strong economy → USD strength

-

Lower-than-expected jobs → Weak economy → USD weakness

💡 NFP is known for causing high volatility in USD pairs like EUR/USD, GBP/USD.

📉 3. Inflation Reports (CPI, PPI)

Inflation measures the rise in prices over time.

-

Rising inflation = Central banks may hike rates = Currency strengthens

-

Falling inflation = Possible rate cuts = Currency weakens

💡 The Consumer Price Index (CPI) is closely monitored for inflation trends.

📉 4. Gross Domestic Product (GDP)

GDP tracks the overall economic output. Strong GDP growth indicates a healthy economy.

-

Strong GDP = Positive for currency

-

Weak GDP = Negative for currency

💡 Quarterly GDP reports can change market sentiment quickly.

📉 5. Unemployment Rate

A low unemployment rate signals economic strength and boosts currency confidence, while high unemployment has the opposite effect.

📉 6. Central Bank Speeches

Sometimes, it’s not just the numbers — it’s the words. When central bank officials speak, traders listen closely for hints about future policy.

💡 A single phrase like “inflation remains elevated” can trigger market moves.

💥 What Happens When News Is Released?

When important news hits:

-

Volatility increases — prices can move fast and unpredictably

-

Spreads widen — brokers increase the cost of trading

-

Liquidity may thin — fewer buyers and sellers = more slippage

The actual data vs. forecast is key:

-

If the actual number is better than expected → Currency may strengthen

-

If the actual is worse → Currency may weaken

-

If in line with expectations → Reaction may be muted

🧠 Example: EUR/USD Reacting to U.S. Interest Rate News

-

Forecast: Fed expected to keep rates unchanged

-

Actual: Fed unexpectedly raises rates

-

Result: USD strengthens, EUR/USD drops sharply

Even if technical analysis showed EUR/USD rising, fundamental news overrules it in the short term.

✅ How to Trade Around Economic News (Safely)

News trading is tempting, but it’s not easy. Here are some smart ways to approach it:

1. Use an Economic Calendar

Track upcoming news events using free calendars (e.g., Forex Factory, Investing.com).

Focus on:

-

High-impact events (often marked in red)

-

Currency pairs likely to be affected

-

Forecast vs. previous data

2. Avoid Trading During Major Releases (as a Beginner)

The volatility can cause:

-

Slippage (you don’t get the price you wanted)

-

Whipsaws (price jumps up and down rapidly)

-

Emotion-based mistakes

💡 Wait for 15–30 minutes after the release to let the market settle.

3. Trade Based on Market Reaction, Not Just the Data

The market doesn’t always react logically to news. Sometimes, a “good” report still leads to a currency drop if expectations were already priced in.

Watch how price behaves after the release:

-

Is it continuing the trend?

-

Is it reversing?

-

Is it showing signs of indecision?

4. Combine Fundamentals with Technical Analysis

Use technicals to identify key levels (support/resistance), then look at fundamentals to confirm your bias or avoid risky trades during news spikes.

🚫 Mistakes to Avoid

-

❌ Trading news blindly without understanding the context

-

❌ Ignoring the forecast and just reacting to headlines

-

❌ Overleveraging in highly volatile environments

-

❌ Holding trades through major events without a plan

🧭 Final Thoughts

Economic news is a powerful force in the forex market. It can create opportunities for big profits — but also big losses if you’re unprepared.

As a trader, you don’t have to trade every news release. But you do need to be aware of when news is coming, how the market might react, and how to protect your capital during high-risk periods.

“Amateurs react. Professionals prepare.”

Stay informed, trade with a plan, and use economic news to your advantage — not your downfall.