How Credit Scores Are Calculated (FICO vs. VantageScore Explained)

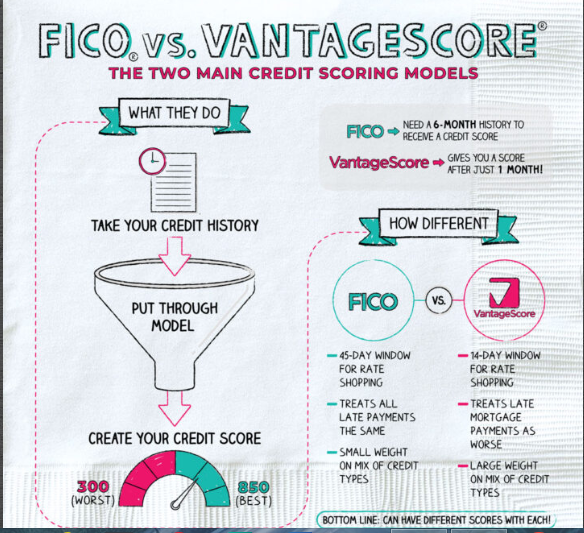

Your credit score is one of the most important numbers in your financial life. Whether you’re applying for a credit card, car loan, or mortgage, lenders use it to decide how risky (or reliable) you are as a borrower. But here’s the twist not all credit scores are the same. The two most widely used scoring models are FICO and VantageScore, and while they look at similar factors, the way they calculate your score can differ.

Let’s break it down.

What Is a Credit Score?

A credit score is a three-digit number that summarizes your creditworthiness. Scores typically range from 300 to 850, with higher scores indicating better credit.

Lenders use these scores to answer one big question: If I lend this person money, how likely am I to get it back on time?

The Two Big Players: FICO vs. VantageScore

FICO Score

Created by the Fair Isaac Corporation, FICO is the most widely used credit scoring model in lending decisions. In fact, about 90% of top lenders use FICO scores when evaluating applications.

FICO Score Breakdown:

-

Payment History (35%) – Do you pay your bills on time?

-

Amounts Owed (30%) – How much of your available credit are you using?

-

Length of Credit History (15%) – How long have your accounts been active?

-

Credit Mix (10%) – Do you have a healthy mix of credit cards, loans, etc.?

-

New Credit (10%) – How many recent credit inquiries or new accounts do you have?

VantageScore

VantageScore was developed by the three major credit bureaus (Equifax, Experian, and TransUnion) as an alternative to FICO. While it’s not as dominant as FICO, it’s becoming more common—especially with free credit score apps.

VantageScore Factors (most recent version, VantageScore 4.0):

-

Payment History (Extremely Influential)

-

Credit Utilization (Highly Influential)

-

Credit Age and Mix (Highly Influential)

-

Balances (Moderately Influential)

-

Recent Credit Applications (Less Influential)

-

Available Credit (Less Influential)

Key Differences Between FICO and VantageScore

-

Scoring Range: Both use 300–850, but some older VantageScore versions went as low as 501.

-

Credit History Requirements:

-

FICO requires at least six months of history before generating a score.

-

VantageScore can generate a score with as little as one month of history.

-

-

Weighting of Factors:

-

FICO uses fixed percentages for categories.

-

VantageScore uses a more flexible weighting system.

-

-

Adoption:

-

FICO dominates lending decisions.

-

VantageScore is more popular with free consumer credit apps.

-

Why It Matters

Since lenders may pull either score, it’s important to understand both. The good news is that the behaviors that improve one score usually improve the other:

-

Pay bills on time, every time

-

Keep balances low (ideally under 30% of your limit)

-

Avoid too many hard inquiries

-

Maintain a healthy mix of credit

-

Check your reports regularly for errors

Final Thoughts

Your credit score isn’t just a number—it’s a financial passport that opens doors to loans, lower interest rates, and even better job or housing opportunities. While FICO remains the gold standard, VantageScore is gaining traction. By practicing healthy credit habits, you’ll keep both scores strong and put yourself in the best financial position possible.