How Business Credit Works (And How It Differs from Personal Credit)

When most people think about credit, they think of personal credit scores the numbers that determine whether you can qualify for a mortgage, car loan, or credit card. But if you’re a business owner (or planning to become one), there’s another type of credit that matters just as much: business credit.

Building strong business credit can open doors to financing, partnerships, and growth opportunities without tying everything to your personal finances. Let’s break down how business credit works and how it differs from personal credit.

What Is Business Credit?

Business credit is a measure of your company’s ability to borrow money and repay it responsibly. Just like personal credit, lenders, suppliers, and even potential business partners use it to gauge your financial reliability.

Your business credit profile is tied to your Employer Identification Number (EIN) rather than your Social Security number. This helps separate your company’s financial identity from your own.

How Business Credit Is Calculated

Unlike personal credit, which is tracked mainly by FICO and VantageScore, business credit has its own bureaus and scoring systems:

-

Dun & Bradstreet PAYDEX Score (0–100): Measures how quickly your business pays its bills. A score of 80+ generally means you pay on time.

-

Experian Business Credit Score (1–100): Evaluates risk of default based on payment history, outstanding balances, and public records.

-

Equifax Business Credit Risk Score (101–992): Predicts the likelihood of delinquency.

Each bureau uses different factors, but overall, timely payments, credit utilization, business history, and public records (like liens or bankruptcies) carry the most weight.

Key Differences Between Business Credit and Personal Credit

-

Credit Tied to Different IDs

-

Personal credit → Tied to your Social Security number.

-

Business credit → Tied to your EIN or business entity.

-

-

Credit Score Ranges

-

Personal credit scores typically range from 300–850.

-

Business credit scores vary by bureau (e.g., 0–100 for PAYDEX).

-

-

Who Can Check It

-

Personal credit reports are private—only lenders and authorized entities can access them.

-

Business credit reports are public—anyone can pay to view them, including vendors, landlords, and competitors.

-

-

Impact on Financing

-

Strong personal credit helps you get personal loans and consumer credit cards.

-

Strong business credit helps your company qualify for business loans, lines of credit, and favorable vendor terms (like “net 30” payments).

-

-

Liability Separation

-

Without business credit, your personal assets may be at risk if your business defaults.

-

With established business credit, your company can stand on its own, reducing personal liability.

-

Why Business Credit Matters

-

Easier Access to Funding: Banks and alternative lenders rely on business credit to approve loans and set interest rates.

-

Better Vendor Relationships: Many suppliers extend trade credit (like net-30 or net-60 terms) based on your business creditworthiness.

-

Separation of Finances: Keeps your personal credit intact, even if your business faces challenges.

-

Professional Credibility: A strong credit profile signals stability and reliability to partners and clients.

How to Build Business Credit

-

Incorporate Your Business or Form an LLC to establish legal separation.

-

Get an EIN from the IRS.

-

Open a Business Bank Account and keep finances separate.

-

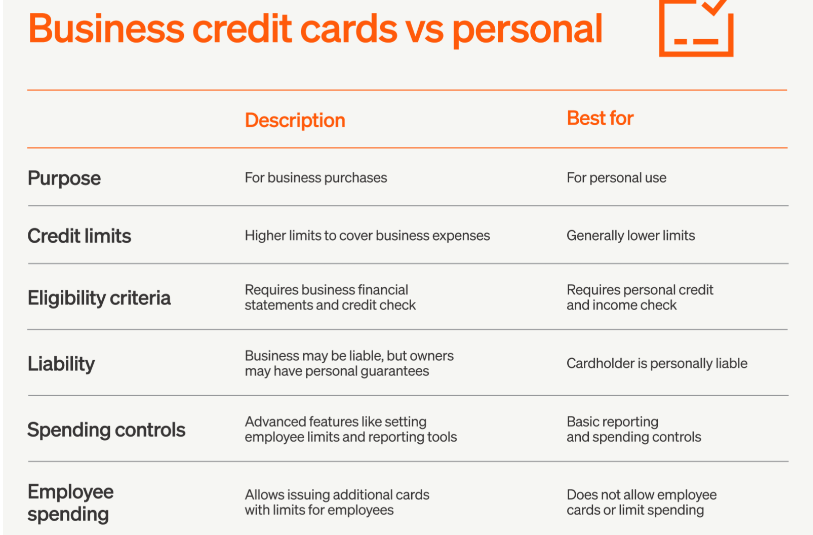

Apply for a Business Credit Card and use it responsibly.

-

Establish Trade Lines with vendors who report to credit bureaus.

-

Pay Bills on Time (or Early). Timeliness is critical for strong business credit scores.

-

Monitor Your Business Credit Reports regularly for accuracy.

Final Thoughts

Business credit is not just a tool for large corporations—it’s essential for small businesses, freelancers, and entrepreneurs too. By separating your personal and business finances, you not only protect yourself but also open the door to better financing, stronger vendor relationships, and long-term growth.

Think of business credit as your company’s financial reputation. Build it wisely, and it will pay dividends for years to come.