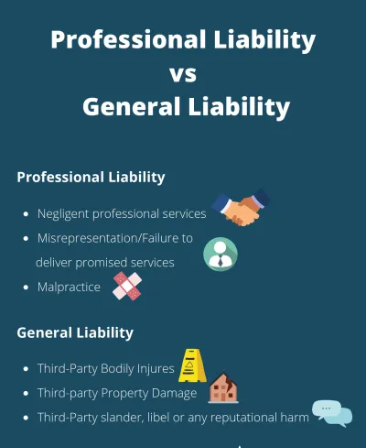

Professional Liability vs. General Liability Insurance

When it comes to protecting your business, not all liability insurance is created equal. Two of the most important and often confused types of coverage are Professional Liability Insurance and General Liability Insurance. While they sound similar, they protect against very different kinds of risks.

In this post, we’ll break down what each type covers, who needs them, and why you might need both.

What Is General Liability Insurance?

General Liability Insurance is sometimes called “business liability insurance.” It protects your business from third-party claims involving:

-

Bodily injury (e.g., someone slips and falls on your premises)

-

Property damage (e.g., you accidentally damage a client’s property)

-

Advertising injury (e.g., claims of slander, libel, or copyright infringement in your ads)

This type of insurance is a must-have for almost all businesses, especially those with a physical location or frequent client interactions.

🛡️ Example:

A customer visits your store, slips on a wet floor, and breaks their ankle. General liability insurance covers their medical bills and your legal defense.

💼 What Is Professional Liability Insurance?

Professional Liability Insurance—also known as Errors & Omissions (E&O) insurance—covers you when a client claims that your professional advice, service, or work caused them financial harm.

It protects against:

-

Negligence

-

Misrepresentation

-

Inaccurate advice

-

Missed deadlines or oversights

This is essential for service-based businesses that offer expert guidance, planning, or specialized services.

🛡️ Example:

You’re a financial consultant who advises a client to invest in a certain stock. The stock tanks, and the client sues you for poor advice. Professional liability insurance helps cover your legal costs and settlement (if any).

🆚 Key Differences at a Glance

| Feature | General Liability Insurance | Professional Liability Insurance |

|---|---|---|

| Covers | Physical injuries, property damage, advertising harm | Financial loss due to errors, omissions, or negligence |

| Who Needs It | Retailers, contractors, landlords, restaurants | Consultants, lawyers, accountants, designers, developers |

| Claim Type | Third-party physical or reputational damage | Service-related claims or mistakes |

| Alternate Name | Business Liability Insurance | Errors & Omissions (E&O) Insurance |

🤔 Do You Need Both?

Yes—if you offer services and also interact with clients or customers in person.

For example, a marketing consultant might need:

-

General Liability Insurance: In case a client slips and falls in their office

-

Professional Liability Insurance: In case a client claims a campaign caused revenue loss

Having both ensures full protection from physical and professional risks.

📌 When to Prioritize Each Type

-

Prioritize General Liability if:

-

You operate from a physical location

-

You attend trade shows or events

-

You have foot traffic at your office or store

-

-

Prioritize Professional Liability if:

-

You provide expert advice or services

-

You work in finance, healthcare, legal, IT, or consulting

-

A mistake in your work could cost your client money

-

💬 Final Thoughts

Understanding the difference between professional and general liability insurance is key to building a solid risk management strategy for your business. Both play a unique role, and together, they offer a well-rounded safety net.