Flood, Fire, and Earthquake Insurance: Are You Covered?

Natural disasters can strike at any moment, often without warning. While many people assume their standard home or renters insurance has them covered, that’s not always the case especially when it comes to floods, fires, and earthquakes.

Understanding what your policy includes (and what it doesn’t) can make all the difference when disaster hits. So, are you really covered?

Let’s break it down.

Flood Insurance: Not Included in Most Policies

The Myth:

“My homeowners insurance will cover flood damage.”

✅ The Truth:

Most standard home and renters insurance policies do not cover flood damage caused by natural disasters (like heavy rain, hurricanes, or overflowing rivers).

To get flood protection, you need a separate flood insurance policy, typically offered through:

-

The National Flood Insurance Program (NFIP)

-

Private flood insurers

💡 Why You Might Need It:

-

Flooding is America’s most common and costly natural disaster

-

Over 25% of flood claims come from areas not considered high-risk

-

Mortgage lenders often require it in flood zones

💰 Cost:

Varies by location, home structure, and flood risk, but average NFIP premiums are around $700–$1,000 per year.

🔥 Fire Insurance: Usually Covered, But Read the Fine Print

✅ The Good News:

Fire damage is typically covered under most standard homeowners, renters, and business insurance policies.

This includes:

-

Structural damage to your home

-

Replacement of personal belongings

-

Smoke damage

-

Temporary living expenses if your home becomes uninhabitable

❗ What to Watch For:

-

Negligence-related fires (e.g., unattended candles) may not be covered

-

Wildfire-prone areas may have coverage limitations or exclusions

-

Some insurance companies may refuse or restrict coverage in high-risk regions

🔥 If You’re in a High-Risk Area:

-

You may need to purchase fire coverage from a state-backed insurance pool (e.g., California FAIR Plan)

🌍 Earthquake Insurance: Often a Separate Policy

🚫 The Myth:

“My home insurance will help if there’s an earthquake.”

✅ The Truth:

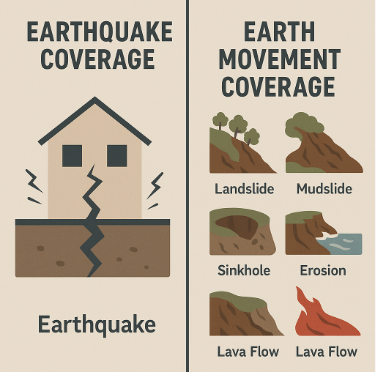

Earthquake damage is not covered by most standard policies. You need a separate earthquake insurance endorsement or policy.

🏚️ What It Covers:

-

Structural damage from ground shaking

-

Damage to personal belongings

-

Additional living expenses if your home is uninhabitable

⚠️ What’s Not Covered:

-

Damage from tsunamis (covered by flood insurance)

-

Land sinkage or soil movement

-

Pre-existing structural issues

💵 Cost:

Premiums can be high in quake-prone areas like California or the Pacific Northwest and vary based on:

-

Location

-

Home age and materials

-

Deductible (often 10–20% of your home’s value)

🧐 How to Know If You’re Covered

✅ Step 1: Review Your Current Insurance Policy

-

Check the declarations page and exclusions

-

Look for “perils not covered” language

-

Identify if you need additional riders or standalone policies

📝 Step 2: Ask Your Agent

-

Do I have coverage for floods, fires, and earthquakes?

-

What’s my deductible for each disaster?

-

What would it cost to add a rider or purchase a separate policy?

🧮 Step 3: Calculate the Risk vs. Cost

Even if you live outside high-risk zones, natural disasters are becoming more frequent and unpredictable. Paying a few hundred dollars a year for extra protection might save you tens (or hundreds) of thousands later.

🔑 Final Thoughts

Standard home or renters insurance won’t always protect you from every type of disaster. Floods, fires, and earthquakes require special attention, and in many cases, additional policies.