Different Types of Insurance Everyone Should Know About

Life is full of unexpected twists and turns accidents, illnesses, theft, disasters, and even death. While you can’t predict what will happen, you can prepare for the unexpected. That’s where insurance comes in.

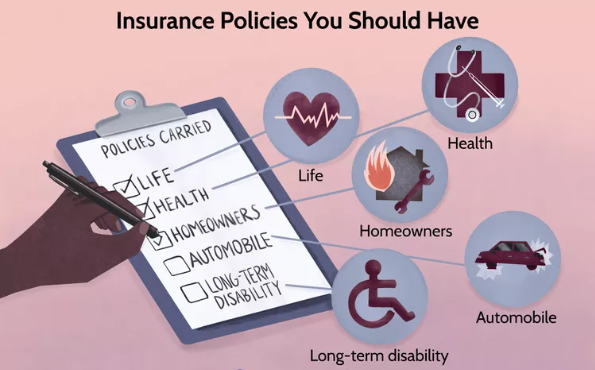

But with so many different types of insurance out there, it can be confusing to know which ones you actually need.

In this post, we’ll break down the main types of insurance everyone should know about and why each one matters.

1. Health Insurance

What it covers: Medical expenses like doctor visits, hospital stays, surgeries, prescriptions, and preventive care.

Why it matters: Healthcare can be incredibly expensive. Health insurance helps reduce your out-of-pocket costs and ensures you get the care you need without financial stress. Even a minor surgery can cost a fortune without coverage.

Who should have it: Everyone. Whether you’re young, middle-aged, or retired, health insurance is a must.

2. Life Insurance

What it covers: Provides a lump-sum payment (death benefit) to your beneficiaries if you die.

Why it matters: Life insurance ensures your loved ones are financially protected if you’re no longer there to support them. It can help cover funeral costs, debts, children’s education, and daily living expenses.

Who should have it: Parents, spouses, business owners, and anyone with financial dependents.

3. Auto Insurance

What it covers: Vehicle damage, theft, third-party injury or damage, and in some cases, medical expenses from accidents.

Why it matters: In many countries, car insurance is legally required. It also protects you from potentially huge costs after an accident or vehicle loss.

Who should have it: Anyone who owns or drives a vehicle.

4. Homeowners or Renters Insurance

Homeowners Insurance:

What it covers: Your house, personal property, liability for injuries on your property, and sometimes additional living expenses if your home becomes unlivable.

Renters Insurance:

What it covers: Your belongings (furniture, electronics, etc.), personal liability, and sometimes temporary housing if needed.

Why it matters: Whether you own or rent, your home is likely your most valuable asset—or at least full of your valuable things. Insurance protects you against fire, theft, natural disasters, and more.

Who should have it: Homeowners and tenants alike.

5. Travel Insurance

What it covers: Trip cancellations, medical emergencies abroad, lost luggage, travel delays, and other disruptions.

Why it matters: A single canceled trip, medical emergency overseas, or lost passport can ruin your travel experience and budget. Travel insurance gives you peace of mind while you’re away.

Who should have it: Frequent travelers, especially for international or long-distance trips.

6. Disability Insurance

What it covers: Replaces a portion of your income if you can’t work due to injury or illness.

Why it matters: Your ability to earn a living is your biggest asset. Disability insurance ensures that if your income stops due to a medical issue, your finances don’t crumble.

Who should have it: Anyone who relies on their income to live especially freelancers, professionals, and sole breadwinners.

7. Business Insurance: Different Types of Insurance Everyone Should Know About

What it covers: Property damage, liability, employee-related risks, lawsuits, and interruptions to business operations.

Why it matters: If you run a business, insurance helps keep you protected from legal claims, disasters, and losses that could otherwise shut your doors for good.

Who should have it: Small business owners, freelancers, and entrepreneurs.

8. Pet Insurance: Different Types of Insurance Everyone Should Know About

What it covers: Veterinary bills, surgeries, medications, and sometimes preventive care.

Why it matters: Pets are family, and unexpected vet bills can cost thousands. Pet insurance helps you afford the best care without breaking the bank.

Who should have it: Pet owners who want to protect their furry friends and their finances.

9. Cyber Insurance: Different Types of Insurance Everyone Should Know About

What it covers: Data breaches, cyberattacks, and digital theft for individuals and businesses.

Why it matters: As our lives become more digital, so do our risks. Identity theft, hacked accounts, or compromised data can be costly cyber insurance helps manage those risks.

Who should have it: Small business owners, online professionals, and high-net-worth individuals.

✅ Final Thoughts on Different Types of Insurance Everyone Should Know About

Insurance isn’t just for the “what ifs” it’s for the when something goes wrong. Understanding the different types of insurance can help you build a well-rounded safety net that protects your health, income, property, and loved ones.

Before choosing any policy, make sure to: Different Types of Insurance Everyone Should Know About

-

Review your needs and lifestyle

-

Compare providers and plans

-

Understand what’s covered (and what’s not)

-

Ask questions when in doubt