Crypto Forks: Hard Fork vs. Soft Fork Explained

If you’ve been exploring the world of cryptocurrency, you’ve probably heard the term “fork” tossed around often in relation to Bitcoin, Ethereum, or some new blockchain project popping up overnight.

But what exactly is a crypto fork, and why does it matter?

In this blog post, we’ll break down what forks are, the difference between a hard fork and a soft fork, and how these events impact users, developers, and investors.

🪓 What Is a Fork in Cryptocurrency?

In simple terms, a fork is when a blockchain splits into two separate paths due to changes in the network’s protocol or rules.

Think of it like updating the rules of a game. Some players follow the new version, while others stick with the old — creating two groups and two possible outcomes.

Forks happen for many reasons:

-

To fix security vulnerabilities

-

To introduce new features

-

To reverse hacks

-

Due to disagreements within the community

🔄 Types of Forks: Hard Fork vs. Soft Fork

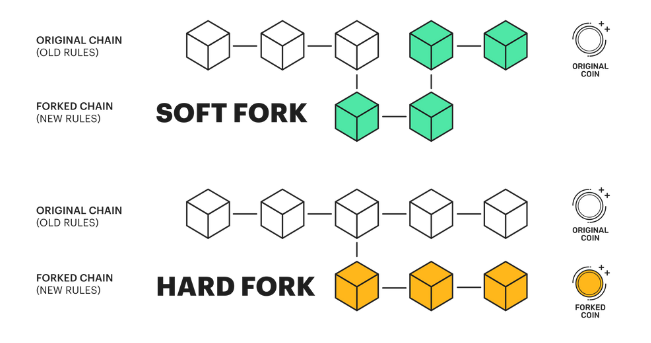

Let’s explore the two main types of forks in crypto: soft forks and hard forks.

🧠 What Is a Soft Fork?

A soft fork is a backward-compatible update to a blockchain protocol.

That means the new rules still work with old nodes that haven’t updated, although those nodes may not fully understand or enforce the new rules.

🧩 Key Features of a Soft Fork:

-

Backward-compatible

-

Typically used for minor upgrades

-

Only one chain continues

-

Doesn’t split the blockchain

🧪 Example:

SegWit (Segregated Witness) was a soft fork on the Bitcoin network in 2017 that improved transaction efficiency by changing how data was stored in blocks — without breaking compatibility.

🪓 What Is a Hard Fork?

A hard fork is a non-backward-compatible change. It introduces a new set of rules that are not compatible with the old version of the software.

This causes a permanent split in the blockchain, resulting in two separate chains and two versions of the coin.

🧩 Key Features of a Hard Fork:

-

Not backward-compatible

-

Creates two separate blockchains

-

Can lead to a new cryptocurrency

-

Requires consensus to prevent disruption

🧪 Examples:

-

Bitcoin Cash (BCH)

In 2017, a group disagreed with Bitcoin’s block size limit and created Bitcoin Cash as a separate chain. -

Ethereum Classic (ETC)

After the DAO hack in 2016, Ethereum reversed the theft through a hard fork — but some users stayed on the original chain, now known as Ethereum Classic.

🔍 Key Differences at a Glance:

| Feature | Soft Fork | Hard Fork |

|---|---|---|

| Compatibility | Backward-compatible | Not backward-compatible |

| Chain Split | No | Yes |

| Impact | Minor upgrades or tweaks | Major changes or disagreements |

| New Coin Created? | No | Often yes (e.g., BCH, ETC) |

| Example | Bitcoin SegWit | Bitcoin Cash, Ethereum Classic |

👥 Why Do Forks Matter?

Forks can have a big impact on:

-

Investors: Hard forks can result in new coins (which may have value).

-

Developers: Forks allow for innovation, upgrades, or ideological shifts.

-

Users: They may need to update wallets, nodes, or software to stay compatible.

Understanding forks helps you:

-

Make informed trading/investing decisions

-

Stay aware of protocol changes

-

Navigate wallet and exchange upgrades properly

⚠️ Are Forks Risky?

Forks can be controversial or risky, especially hard forks:

-

Market volatility: Prices may swing sharply before or after a fork.

-

Replay attacks: Without proper protections, transactions can be duplicated across chains.

-

Confusion: Users might accidentally send coins to the wrong chain.

👉 Tip: Before a hard fork, check if your wallet or exchange supports the new coin and make sure your private keys are safe.

🔮 Final Thoughts

Crypto forks are a natural part of blockchain evolution. They represent progress, innovation, and sometimes disagreement. Understanding the difference between soft forks and hard forks helps you stay informed and make smarter decisions in the fast-moving world of crypto.