Business Credit: How to Build It and Why It Matters

When most entrepreneurs think about credit, they immediately think about personal credit scores. But if you own a business whether it’s a one-person shop or a growing company you also need to understand and build commercial credit.

Strong commercial credit can unlock funding, help you negotiate better terms with suppliers, and separate your personal finances from your company’s risk. Unfortunately, many small business owners overlook it until it’s too late.

Here’s what business credit is, why it matters, and how you can start building it today.

What Is commercial credit?

Business credit is similar to personal credit, but it tracks your company’s ability to borrow and repay money. It’s based on your business’s financial history—things like payment records, outstanding debts, and credit utilization.

Credit bureaus such as Dun & Bradstreet, Experian Business, and Equifax Business maintain these reports, assigning your company a credit score that lenders, vendors, and partners can view.

Why Business Credit Matters

-

Access to Funding

Lenders are more likely to approve loans and lines of credit for businesses with strong credit histories. -

Better Terms with Vendors and Suppliers

Good credit can qualify you for trade credit—allowing you to buy now and pay later—improving cash flow. -

Separation of Personal and Business Finances

A strong business credit profile reduces reliance on personal credit cards or loans. This protects your personal assets and credit score. -

Lower Interest Rates

Just like personal credit, a higher business credit score can mean better interest rates on loans. -

Business Growth Opportunities

When you want to scale, strong credit makes it easier to secure larger financing quickly.

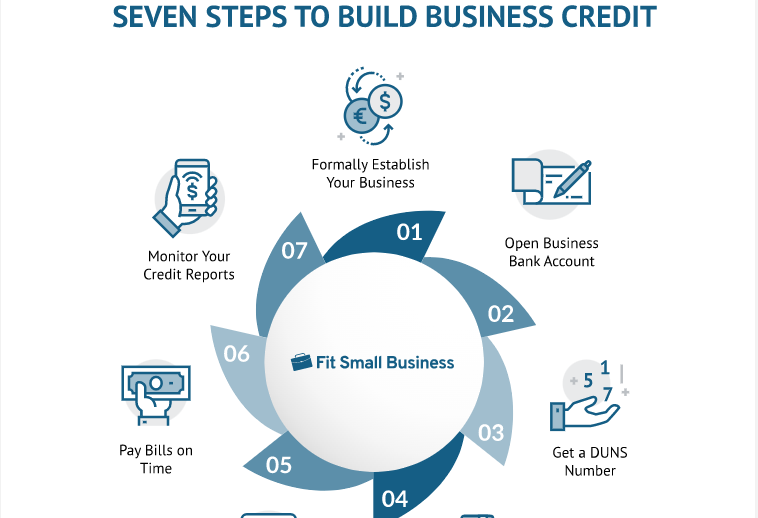

How to Build Business Credit

1. Register Your Business Properly

Form an LLC or corporation, and get an Employer Identification Number (EIN). This creates a clear legal and financial separation between you and your business.

2. Open a Business Bank Account

Keep personal and business transactions separate. A dedicated account builds legitimacy and is often required by lenders.

3. Apply for a Business Credit Card

Use it for business-related expenses, and pay the balance on time (or early). This establishes a credit history.

4. Work with Vendors That Report to Credit Bureaus

Not all suppliers report payments. Choose those who do and always pay on time to build your score.

5. Pay Bills Early (Not Just on Time)

Early payments can boost your business credit score and establish you as a reliable partner.

6. Monitor Your Business Credit Reports

Regularly check for errors or outdated information. Correcting mistakes can quickly improve your score.

Common Mistakes to Avoid

-

Using personal credit exclusively for business expenses

-

Failing to register your business legally

-

Missing or delaying vendor payments

-

Ignoring your business credit reports until you need a loan

Final Thoughts

Business credit is more than just a financial formality—it’s a growth tool. By building and maintaining strong credit, you give your company flexibility, stability, and credibility.

Whether you’re looking to secure a loan, negotiate better deals, or protect your personal finances, strong business credit can make the difference between struggle and success.

The sooner you start building it, the stronger your business foundation will be.