Budgeting for Entrepreneurs: Separating Personal and Business Finances

One of the most common mistakes entrepreneurs make especially in the early days is mixing personal and business finances. While it may seem harmless to pay for office supplies with your personal debit card or use business earnings to cover household expenses, blurred financial lines can quickly create chaos.

Proper budgeting and clear separation of finances not only keep you organized but also protect your business, simplify taxes, and help you make smarter money decisions.

Why Separating Personal and Business Finances Matters

-

Clear Financial Picture

If your personal and business expenses are mixed together, it’s nearly impossible to know how well your business is truly performing. Separation allows you to track profits, losses, and expenses accurately. -

Easier Tax Filing

Blended finances can turn tax season into a nightmare. By keeping everything separate, you’ll have clean records, reduce errors, and even maximize your deductions. -

Professionalism and Credibility

Having a dedicated business account shows partners, clients, and investors that you’re serious about your venture. It also helps build business credit, which can be useful when applying for loans or lines of credit. -

Legal Protection

If your business is registered as an LLC or corporation, mixing funds could put your personal assets at risk in the event of lawsuits or debt. Separation helps preserve your liability protection.

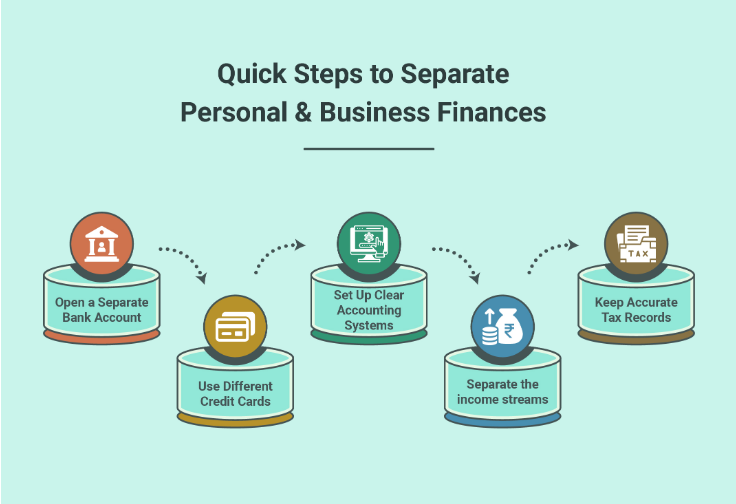

Steps to Separate Personal and Business Finances

1. Open a Business Bank Account

Choose a dedicated account for your business income and expenses. This is your financial foundation.

2. Get a Business Credit Card

Use a separate credit card for business-related purchases. This helps track expenses and may even earn rewards on things like advertising or travel.

3. Pay Yourself a Salary or Draw

Instead of dipping into business funds whenever you need money, establish a set amount you’ll transfer to your personal account—either as a salary (for corporations) or an owner’s draw (for sole proprietors/LLCs).

4. Use Accounting Tools

Leverage software like QuickBooks, FreshBooks, or Wave to categorize transactions, create invoices, and generate financial reports.

5. Set a Business Budget

Outline expected income, recurring expenses (like rent, software subscriptions, or salaries), and allocate funds for growth. This keeps you disciplined and avoids overspending.

How to Build a Budget That Works

-

List Your Fixed Costs (rent, utilities, insurance, subscriptions)

-

Plan for Variable Costs (marketing campaigns, travel, materials)

-

Include Savings (emergency fund, reinvestment, taxes)

-

Track and Adjust monthly based on actual results

A good rule of thumb: reinvest at least 20–30% of profits back into the business while keeping personal withdrawals reasonable.

Common Pitfalls to Avoid

-

Using personal credit cards for business expenses

-

Forgetting to save for taxes

-

Paying personal bills directly from business accounts

-

Ignoring small expenses that add up over time

Final Thoughts

Budgeting is the backbone of financial success for entrepreneurs. By separating personal and business finances, you create clarity, protect yourself legally, and set your company up for long-term growth.

Think of your business as its own entity—it earns money, pays bills, invests in growth, and then pays you. When you respect that separation, you’ll find it easier to scale, attract investors, and keep your financial life stress-free.