Auto Loans: What You Need to Know Before Buying a Car

Buying a car can be exciting but unless you’re paying in full with cash, you’ll probably need an auto loan to make it happen.

Understanding how auto loans work before heading to the dealership can save you money, stress, and potential regret.

1. What Is an Auto Loan?

An auto loan is a type of financing that lets you purchase a vehicle and pay for it over time.

You borrow the purchase price (minus your down payment) from a lender, and repay it plus interest over an agreed term.

Key Players in Auto Financing:

-

Banks & Credit Unions – Often offer competitive rates, especially for existing members.

-

Online Lenders – Convenient application process, but rates vary widely.

-

Dealership Financing – Quick and easy, but may come with higher rates or extra fees.

2. Key Terms to Understand

Before signing anything, know these terms inside and out:

-

APR (Annual Percentage Rate): The yearly cost of borrowing, including interest and fees.

-

Loan Term: The length of the loan, typically 36–72 months.

-

Down Payment: Money you pay upfront; reduces your loan amount and monthly payment.

-

Depreciation: How quickly your car loses value important for avoiding “upside-down” loans (owing more than your car is worth).

3. Factors That Affect Your Auto Loan Rate

Your interest rate isn’t random it’s based on:

-

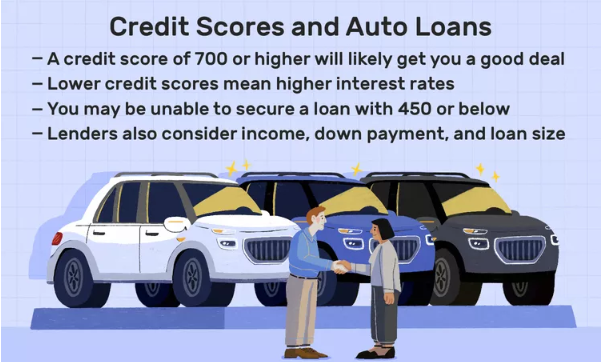

Credit Score: Higher scores = lower rates.

-

Income & Debt-to-Income Ratio: Lenders want proof you can repay.

-

Vehicle Age & Type: New cars often get lower rates than used ones.

-

Loan Term: Shorter terms usually have lower rates, but higher monthly payments.

4. Common Auto Loan Mistakes to Avoid

-

Focusing only on the monthly payment instead of the total loan cost.

-

Not shopping around dealers’ first offers aren’t always the best.

-

Financing for too long a 7-year loan may sound affordable but costs much more in interest.

-

Rolling old debt into a new loan, which increases your balance and risk of negative equity.

5. Tips for Getting the Best Auto Loan in 2025

-

Check your credit before you shop fixing errors could lower your rate.

-

Get pre-approved from a bank or credit union before visiting a dealership.

-

Make a larger down payment to reduce both interest and monthly payments.

-

Consider total cost of ownership insurance, maintenance, fuel, and taxes matter as much as the loan itself.

Bottom Line

An auto loan can help you drive off the lot sooner, but the wrong financing choice can cost thousands over time.

By understanding loan terms, shopping around for the best rate, and avoiding long repayment periods, you can buy smarter and save more.