The Future of Credit Scoring: AI, Alternative Data & More

For decades, credit scores have been the backbone of lending decisions. Lenders have relied heavily on models like FICO and VantageScore, which use factors such as payment history, credit utilization, and length of credit history to determine your creditworthiness. But the world is changing and so is the way credit is scored.

With the rise of artificial intelligence (AI), alternative data, and digital finance, the future of credit scoring looks very different from the traditional system we know today.

The Limitations of Traditional Credit Scoring

Traditional scoring models, while widely used, come with notable flaws:

-

Excludes the “credit invisible”: Millions of people, especially young adults, immigrants, and low-income households, have little or no credit history. This makes it hard for them to access loans.

-

Limited data sources: Current scores are based mainly on credit cards, loans, and mortgages. They don’t factor in modern financial behaviors like paying rent or subscription bills.

-

Slow to adapt: Traditional models can take months to reflect financial improvements, leaving borrowers stuck with outdated scores.

These gaps are driving innovation and technology is stepping in to fill them.

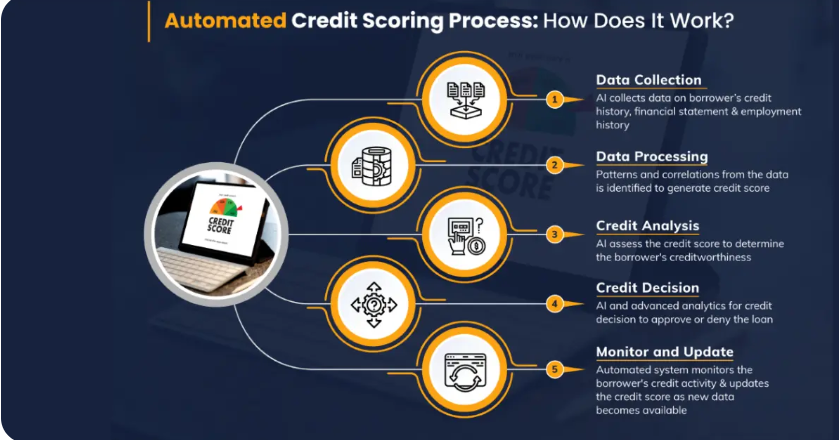

AI in Credit Scoring

Artificial intelligence is transforming credit scoring by analyzing far more data points than traditional models. Instead of focusing only on credit reports, AI can consider:

-

Banking transactions and cash flow patterns

-

Spending habits and savings behavior

-

Employment history and income stability

-

Even non-traditional signals like mobile phone payments or online marketplace activity

The benefit? More accurate and fair assessments of risk. AI can help lenders approve more qualified borrowers who might be overlooked by traditional systems, while also reducing defaults.

But there’s a catch: AI-based models must be designed carefully to avoid bias and discrimination, ensuring they remain fair and transparent.

The Rise of Alternative Data

“Alternative data” refers to information beyond the typical credit report. Lenders and fintechs are already experimenting with:

-

Rent payments (on-time rent can show financial responsibility)

-

Utility bills (electricity, water, phone bills as proof of reliability)

-

Streaming/subscription payments (Netflix, Spotify, etc.)

-

Digital wallets & mobile payments (PayPal, CashApp, Venmo transaction history)

The goal is to give people who lack traditional credit a way to demonstrate trustworthiness. For example, Experian Boost allows consumers to add utility and phone payments to their credit history—often raising their scores instantly.

Global Innovations in Credit Scoring

Outside the U.S., countries are already pushing boundaries:

-

China’s Social Credit experiments use a wide range of behavioral data, from shopping to social media, to assess trustworthiness (though not without controversy).

-

Africa & India: Mobile money transactions and microloan repayment histories are becoming key parts of credit assessments, helping more people access financial services.

-

Europe: Open banking regulations allow consumers to share transaction data directly with lenders for better, faster credit decisions.

What the Future Looks Like

The next decade of credit scoring will likely include:

-

Hybrid Models – Blending traditional FICO-style scores with AI-driven insights and alternative data.

-

Real-Time Credit Scoring – Instant updates based on current financial behavior, not just past mistakes.

-

Consumer-Controlled Data – Borrowers deciding which data to share with lenders, thanks to open banking and privacy-focused fintech tools.

-

Fairer Access – Helping credit-invisible populations gain access to loans and financial products they deserve.

Final Thoughts

The future of credit scoring is about inclusion, accuracy, and technology. AI and alternative data promise a world where your ability to get credit isn’t limited to whether you’ve had a credit card or mortgage in the past. Instead, lenders will see a fuller picture of your financial habits.

For consumers, this means more opportunities to build credit, even if you’re starting from scratch. For lenders, it means smarter, safer decisions.

The challenge will be ensuring these systems remain transparent, ethical, and bias-free as they reshape the way we borrow and lend.