What to Do If Your Identity Is Stolen

Identity theft is one of the fastest-growing crimes in the world, and it can happen to anyone. From stolen credit card numbers to fraudulent loans opened in your name, the consequences can be stressful and financially damaging.

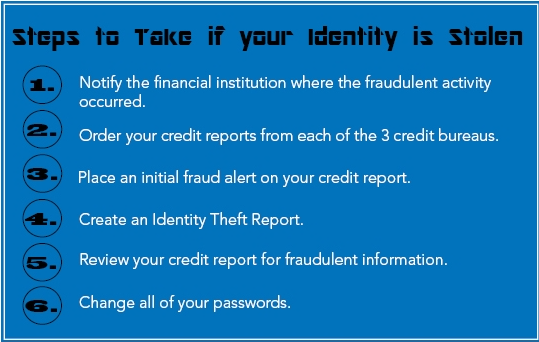

But don’t panic if you act quickly, you can limit the damage and start restoring your financial security. Here’s a step-by-step guide on what to do if your identity is stolen.

Step 1: Recognize the Signs of Identity Theft

Some common red flags include:

-

Unfamiliar accounts or charges on your credit report.

-

Bills or debt collection calls for accounts you didn’t open.

-

Notifications about password changes you didn’t make.

-

Denials for credit you didn’t apply for.

-

A sudden drop in your credit score without reason.

If something feels off, it’s better to investigate immediately.

Step 2: Place a Fraud Alert on Your Credit Reports

Contact one of the three major credit bureaus (Equifax, Experian, or TransUnion) and ask for a fraud alert. That bureau must notify the others.

A fraud alert makes it harder for thieves to open new accounts in your name, since lenders will need extra verification before granting credit.

👉 You can also consider a credit freeze, which locks your credit report completely until you lift it.

Step 3: Review Your Credit Reports

Get free copies of your reports at AnnualCreditReport.com. Check for accounts you don’t recognize, incorrect balances, or changes in your personal information.

Step 4: Report the Theft to the FTC

File an official identity theft report at IdentityTheft.gov. The Federal Trade Commission will create:

-

A recovery plan tailored to your case.

-

An official report you can use to dispute fraudulent accounts.

Step 5: Contact Affected Companies

Call the fraud departments of banks, credit card companies, or lenders where fraudulent activity occurred. Explain the situation, provide your FTC report, and ask them to:

-

Close or freeze the fraudulent accounts.

-

Remove any unauthorized charges.

-

Confirm in writing that your dispute is being investigated.

Step 6: File a Police Report (If Necessary)

If you know who stole your identity or if the fraud involves large amounts of money, file a police report. Bring copies of your FTC report, proof of fraudulent accounts, and any other evidence.

Step 7: Change Your Passwords and Secure Your Accounts

Update passwords for all financial accounts, email, and online services. Use strong, unique passwords and enable two-factor authentication wherever possible.

Step 8: Monitor Your Credit and Finances Closely

-

Sign up for credit monitoring services to get alerts on new activity.

-

Check your bank statements regularly.

-

Review your credit reports every few months.

Identity thieves may strike again, so staying vigilant is key.

Step 9: Consider Extra Protection

If the breach is severe, you may want to:

-

Work with an identity theft protection service.

-

Request a new Social Security number (in rare, extreme cases).

-

Sign up for alerts with your bank and credit card issuers.

Final Thoughts

Discovering that your identity has been stolen can feel overwhelming, but you’re not powerless. By acting fast—placing fraud alerts, reporting the theft, and securing your accounts—you can minimize the damage and reclaim control of your financial life.

Think of it this way: identity theft is a setback, not a life sentence. The sooner you respond, the sooner you can recover.