Hard Inquiries vs. Soft Inquiries: What’s the Difference?

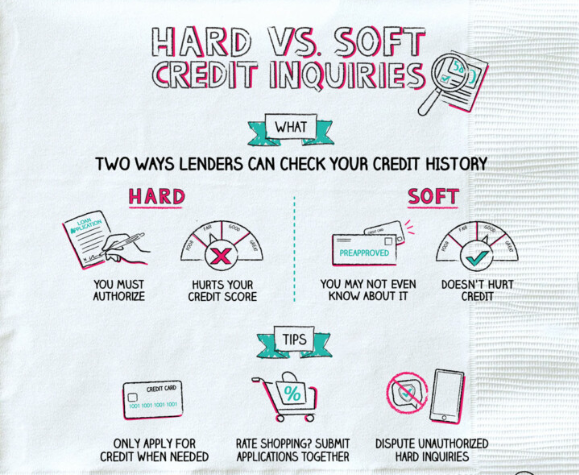

When you apply for a loan, credit card, or even check your own credit score, the lender or service provider may run a credit inquiry. But not all inquiries are the same some can affect your credit score, while others won’t.

That’s where the terms hard inquiry and soft inquiry come in. Understanding the difference is crucial if you’re trying to protect your credit health.

What Is a Credit Inquiry?

A credit inquiry happens when someone checks your credit report to evaluate your financial history. Inquiries show up on your credit report so that you and potential lenders can see who has been accessing your information.

Now, let’s break down the two types.

What Is a Hard Inquiry?

A hard inquiry (also called a “hard pull”) occurs when a lender reviews your credit because you’ve applied for a line of credit.

Examples of hard inquiries:

-

Applying for a credit card.

-

Applying for a mortgage, car loan, or personal loan.

-

Applying for certain types of student loans.

How hard inquiries affect your score:

-

A hard inquiry can lower your credit score slightly (typically 5 points or less).

-

Too many hard inquiries in a short time can signal risk to lenders, especially if you look like you’re “credit shopping.”

-

Hard inquiries stay on your credit report for two years, but only affect your credit score for about one year.

👉 Tip: Rate shopping for a mortgage or auto loan within a short period (usually 14–45 days) is usually treated as a single inquiry, so it won’t hurt your score much.

What Is a Soft Inquiry?

A soft inquiry (or “soft pull”) happens when your credit is checked for reasons unrelated to a new credit application.

Examples of soft inquiries:

-

Checking your own credit score.

-

Pre-qualification checks by credit card issuers.

-

Background checks for employment or rental applications (in some cases).

-

Existing lenders reviewing your account.

How soft inquiries affect your score:

-

They don’t affect your credit score at all.

-

They may appear on your credit report, but only you can see them—lenders cannot.

Key Differences at a Glance

| Feature | Hard Inquiry | Soft Inquiry |

|---|---|---|

| Purpose | Credit application | Pre-checks, personal review, background checks |

| Impact on Score | Yes, small and temporary | No impact |

| Visible to Lenders | Yes | No |

| Stays on Report | 2 years (affects score ~12 months) | 2 years (but harmless) |

How to Manage Inquiries Wisely

-

Limit applications: Only apply for new credit when you really need it.

-

Space out applications: Multiple hard pulls in a short time can hurt your score.

-

Don’t fear soft pulls: Check your credit regularly—it won’t harm your score.

-

Use pre-qualification tools: Many banks and credit card companies let you see if you’re likely to be approved with just a soft inquiry.

Final Thoughts

Hard inquiries and soft inquiries may seem like small details, but they can make a big difference in how lenders view you. While soft pulls are harmless, hard pulls should be managed carefully to avoid unnecessary hits to your credit score.