The Snowball vs. Avalanche Method: Which Debt Payoff Strategy Works Best?

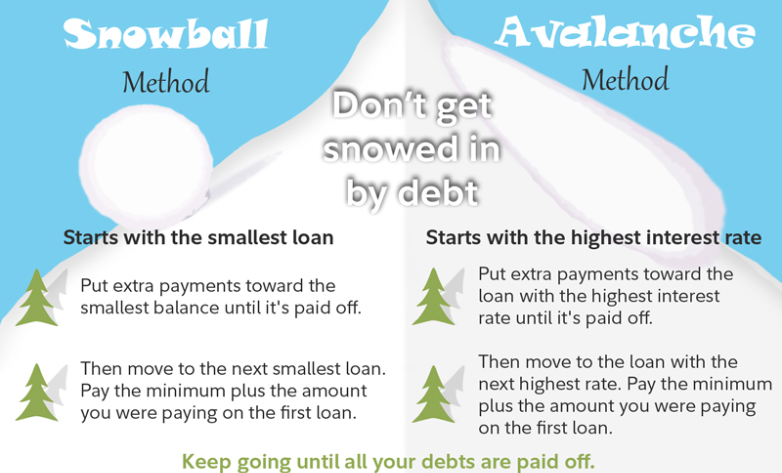

Debt can feel overwhelming, but having the right repayment strategy can make all the difference. Two of the most popular approaches the Snowball Method and the Avalanche Method take different routes to the same goal: becoming debt-free.

Both can work, but which one is best for you depends on your personality, motivation, and financial goals. Let’s break them down.

The Snowball Method: Small Wins First

How it works:

-

List all your debts from smallest balance to largest.

-

Pay the minimum on all debts except the smallest.

-

Throw every extra dollar at the smallest debt until it’s paid off.

-

Move to the next smallest, adding the freed-up payment to the next balance (your “snowball” grows).

Pros:

-

Quick wins build momentum and motivation.

-

Easy to stick with because you see progress early.

Cons:

-

You might pay more in total interest over time compared to the Avalanche Method.

Best for:

People who need quick psychological wins to stay motivated.

The Avalanche Method: Highest Interest First

How it works:

-

List all your debts from highest interest rate to lowest.

-

Pay the minimum on all debts except the one with the highest interest.

-

Put every extra dollar toward that high-interest debt.

-

Once it’s gone, tackle the next highest interest rate, and so on.

Pros:

-

Saves you the most money in interest over time.

-

Helps you become debt-free faster in many cases.

Cons:

-

Progress can feel slow at first, especially if your highest-interest debt is large.

Best for:

People who are motivated by saving money and sticking to a plan, even without early wins.

Which Method Should You Choose?

Ask yourself:

-

Do I get discouraged easily? → Go Snowball.

-

Am I disciplined and numbers-driven? → Go Avalanche.

For some people, a hybrid approach works best—start with Snowball for motivation, then switch to Avalanche to save more on interest.

Example Side-by-Side

Let’s say you have:

-

$2,000 credit card at 19% interest

-

$4,000 personal loan at 10% interest

-

$1,000 store card at 25% interest

Snowball order: $1,000 store card → $2,000 credit card → $4,000 personal loan

Avalanche order: $1,000 store card → $2,000 credit card → $4,000 personal loan (in this example, first two match due to interest rates)

The difference? If your debts and interest rates vary more, Avalanche may save you hundreds in interest—but Snowball might keep your motivation higher.

The Bottom Line

There’s no one-size-fits-all answer. The best debt payoff strategy is the one you’ll stick with. Whether you choose the Snowball’s emotional boost or the Avalanche’s interest savings, the important part is to start—and keep going—until you’re debt-free.