The 50/30/20 Rule Explained: How to Budget Without Overthinking

If the word budget makes you picture spreadsheets, endless receipts, and late-night math sessions, you’re not alone. Many people think managing money has to be complicated. But it doesn’t.

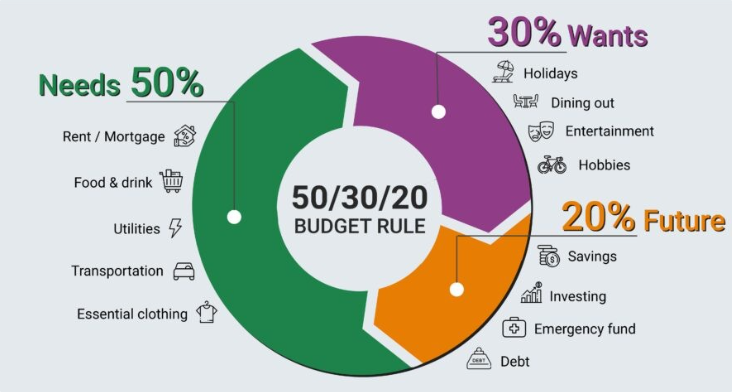

Enter the 50/30/20 Rule a straightforward budgeting framework that helps you spend wisely, save consistently, and avoid financial stress. No complicated formulas. No obsessive tracking. Just three numbers.

What Is the 50/30/20 Rule?

The 50/30/20 Rule is a money management method popularized by U.S. Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan. It divides your after-tax income into three simple categories:

-

50% – Needs

Essential expenses you can’t avoid, such as:-

Rent or mortgage

-

Utilities (electricity, water, internet)

-

Groceries

-

Transportation

-

Minimum debt payments

-

Insurance

-

-

30% – Wants

Things that make life more enjoyable but aren’t essential, such as:-

Dining out

-

Vacations

-

Streaming subscriptions

-

Shopping for clothes beyond necessities

-

Hobbies and entertainment

-

-

20% – Savings & Debt Repayment

Your financial future and security:-

Emergency fund contributions

-

Retirement savings (401k, IRA, pension)

-

Extra debt payments (above the minimum)

-

Investments

-

Why It Works

The genius of the 50/30/20 Rule is its simplicity:

-

You only need to track three spending buckets.

-

It’s flexible you can adjust slightly if your lifestyle or location demands it.

-

It ensures you’re not neglecting savings while still enjoying life.

Example: 50/30/20 in Action

Let’s say your after-tax income is $3,000/month:

-

Needs (50%) → $1,500

-

Wants (30%) → $900

-

Savings/Debt Repayment (20%) → $600

This gives you a quick blueprint for where your money should go without having to account for every single coffee you buy.

Tips to Make It Work for You

-

Start with your real numbers – Track your spending for one month to see where your money goes.

-

Adjust for your reality – If you live somewhere with high rent, your needs might be 60% and wants 20%.

-

Automate savings – Set up automatic transfers so you don’t have to rely on willpower.

-

Review quarterly – Life changes, so revisit your budget every few months.

The Bottom Line

The 50/30/20 Rule isn’t about restriction it’s about clarity and balance. It helps you cover essentials, enjoy life now, and still prepare for the future, all without feeling like budgeting is a second job.

If you’ve been avoiding budgeting because it feels overwhelming, this might be your perfect starting point. After all, the best budget is the one you’ll actually stick to.