Should You Borrow from a Bank, Credit Union, or Online Lender?

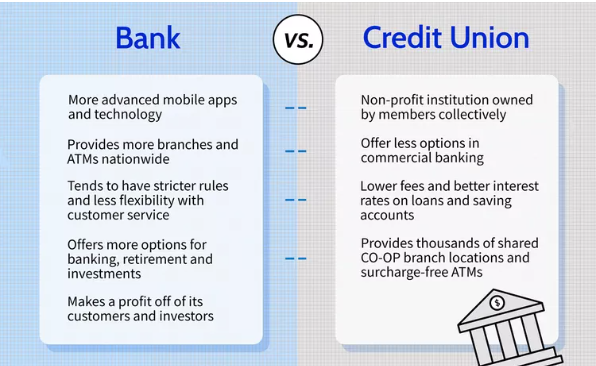

When you need a loan whether for a new car, a home improvement project, or consolidating debt you have more borrowing options than ever before. But choosing between a bank, credit union, or online lender can feel like comparing apples, oranges, and… virtual fruit.

Each option comes with unique benefits and trade-offs. Let’s break them down so you can make the best decision for your financial situation.

1. Borrowing from a Bank

Best for: Established customers who value in-person service and traditional stability.

Pros:

-

Wide range of loan products.

-

Physical branches for face-to-face help.

-

May offer relationship discounts if you’re already a customer.

Cons:

-

Stricter lending requirements (higher credit score and income thresholds).

-

Slower approval process compared to online lenders.

-

Rates may not always be the most competitive.

Ideal if… you have strong credit, prefer traditional service, and like the reassurance of a well-established institution.

2. Borrowing from a Credit Union

Best for: Members who want lower rates, personal service, and community focus.

Pros:

-

Typically lower interest rates and fees than banks.

-

More flexible approval standards—better for borrowers with fair credit.

-

Member-focused, not-for-profit structure.

Cons:

-

Must meet membership requirements (location, employer, or group affiliation).

-

Smaller loan offerings compared to big banks.

-

Fewer branches and limited tech features in some cases.

Ideal if… you’re eligible for membership, value personalized service, and want lower costs.

3. Borrowing from an Online Lender

Best for: Fast approvals, convenience, and tech-savvy borrowers.

Pros:

-

Quick application and approval process (sometimes same-day funding).

-

Competitive rates—especially for those with strong credit.

-

24/7 accessibility from your phone or laptop.

Cons:

-

No physical branches—service is entirely digital.

-

Some lenders may charge higher rates for borrowers with lower credit.

-

Risk of scams—always verify the lender is legitimate.

Ideal if… speed, convenience, and competitive rates are your top priorities, and you’re comfortable managing everything online.

Which Should You Choose?

Here’s a quick decision guide:

-

Bank → You want in-person support, have excellent credit, and are already a customer.

-

Credit Union → You want lower rates and more flexibility, and you qualify for membership.

-

Online Lender → You need fast funding, competitive rates, and you’re comfortable with a fully digital process.

Bottom Line

The “best” lender depends on your needs, credit profile, and how you like to manage your finances. For many borrowers, comparing offers from all three types is the smartest move—so you can get the best rate and terms while avoiding costly surprises.