Home Loans Explained: FHA, VA, USDA, and Conventional

Buying a home is one of the biggest financial decisions you’ll make and the type of mortgage you choose can affect your monthly payment, down payment, and long-term costs.

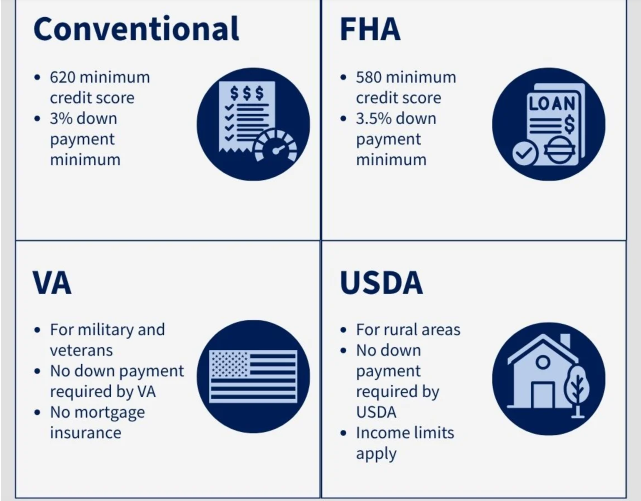

Let’s break down four of the most common home loan types: FHA, VA, USDA, and Conventional.

1. FHA Loans

Best for: First-time homebuyers or those with lower credit scores.

-

Backed by: The Federal Housing Administration (FHA).

-

Credit Score Requirement: As low as 580 (with 3.5% down) or 500 (with 10% down).

-

Down Payment: Minimum 3.5% (for qualifying scores).

-

Pros: Easier qualification, low down payment, competitive rates.

-

Cons: Requires mortgage insurance (MIP) for the life of the loan, which increases costs.

✅ Tip: FHA loans are great if you don’t have perfect credit or a large down payment saved, but plan for the extra insurance expense.

2. VA Loans

Best for: Veterans, active-duty military, and some surviving spouses.

-

Backed by: The U.S. Department of Veterans Affairs (VA).

-

Credit Score Requirement: No official minimum (lenders often prefer 620+).

-

Down Payment: $0—no down payment required.

-

Pros: No mortgage insurance, no down payment, competitive interest rates.

-

Cons: Only available to eligible military service members and families.

✅ Tip: If you qualify, a VA loan is often the best mortgage option because it eliminates down payments and mortgage insurance entirely.

3. USDA Loans

Best for: Buyers in rural or certain suburban areas with low-to-moderate incomes.

-

Backed by: The U.S. Department of Agriculture (USDA).

-

Credit Score Requirement: Often 640+ (varies by lender).

-

Down Payment: $0—no down payment required.

-

Pros: No down payment, reduced mortgage insurance, low interest rates.

-

Cons: Restricted to eligible rural and some suburban locations; income limits apply.

✅ Tip: Check the USDA property eligibility map—many areas just outside cities qualify and offer big savings.

4. Conventional Loans

Best for: Buyers with strong credit and stable income.

-

Backed by: Private lenders (not government-insured).

-

Credit Score Requirement: Typically 620+; better scores = better rates.

-

Down Payment: Minimum 3% (many put 5–20% down).

-

Pros: Flexible loan terms, no lifetime mortgage insurance (can remove PMI once you reach 20% equity).

-

Cons: Stricter credit and income requirements.

✅ Tip: If you have good credit and at least a 20% down payment, you can avoid mortgage insurance entirely.

Which Loan Is Right for You?

| Loan Type | Down Payment | Credit Score | Ideal For |

|---|---|---|---|

| FHA | 3.5%+ | 580+ | First-time buyers, lower credit |

| VA | $0 | 620+* | Veterans & military families |

| USDA | $0 | 640+ | Rural buyers, low-to-moderate income |

| Conventional | 3%+ | 620+ | Strong credit, stable income |

*No official VA minimum, but lenders may set their own.

Bottom Line

Choosing the right home loan is about more than just interest rates—it’s about matching the loan’s benefits to your financial situation and homeownership goals.

Whether you’re looking for low down payments, no mortgage insurance, or flexible terms, there’s an option out there to fit your needs.