What Is a Personal Loan and When Should You Get One?

When life throws you a financial curveball or an exciting opportunity having access to funds can make all the difference. That’s where personal loans come in.

Personal loans are one of the most flexible and widely used financial products available today. But like any form of debt, they’re not always the right fit for every situation. In this post, we’ll break down what a my loan is, how it works, and when it makes sense to apply for one.

What Is a Personal Loan?

A my loan is a type of installment loan that allows you to borrow a fixed amount of money and repay it in regular monthly payments typically over 1 to 7 years.

Most loans are unsecured, meaning you don’t have to put up collateral (like a car or house). Instead, lenders base approval on your credit score, income, debt-to-income ratio, and overall financial health.

Key Features of Personal Loans

-

Loan Amounts: Typically range from $1,000 to $100,000

-

Repayment Terms: Usually 12 to 84 months

-

Interest Rates: Fixed or variable; often between 6% and 36% APR

-

Funding Time: Often within 1–5 business days

-

No Collateral Needed: Most personal loans are unsecured

Common Uses for a Personal Loan

Personal loans can be used for almost any purpose. Here are some of the most common (and responsible) reasons to consider one:

✅ 1. Debt Consolidation

Combine multiple high-interest debts (like credit cards) into a single loan with a lower interest rate and fixed monthly payment.

✅ 2. Medical Expenses

Cover unexpected medical bills or emergency procedures without dipping into savings.

✅ 3. Home Improvements

Finance renovations or repairs that can increase the value of your home.

✅ 4. Major Life Events

Weddings, funerals, or moving expenses can be covered without resorting to high-interest credit cards.

✅ 5. Education or Career Development

While student loans may be more suitable for tuition, a personal loan can help with certification programs, equipment, or relocation for a new job.

✅ 6. Emergency Expenses

Car repairs, appliance replacements, or other urgent needs that require quick access to cash.

⚠️ When You Shouldn’t Get a Personal Loan

While personal loans can be helpful, they’re not always the best choice. Avoid using them for:

-

Non-essential purchases (like vacations or luxury items)

-

Investments (risky if the return doesn’t exceed the cost of the loan)

-

Covering ongoing cash flow problems (this can lead to a debt spiral)

If you’re struggling to make ends meet month after month, a loan may only be a short-term fix. In such cases, speaking with a financial counselor might be a better first step.

🔍 How to Qualify for a Personal Loan

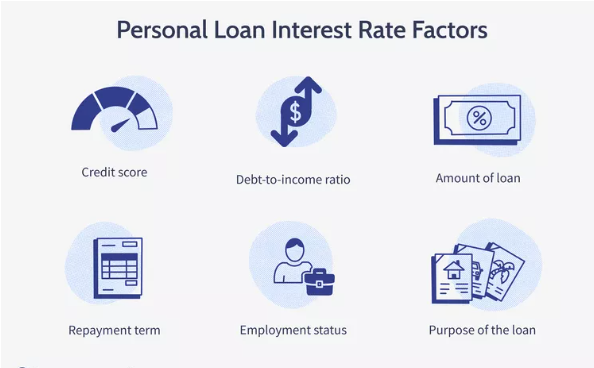

Lenders typically evaluate:

-

Credit score (good or excellent increases your chances)

-

Income and employment history

-

Debt-to-income (DTI) ratio

-

Loan purpose

If your credit is low, you may still qualify but at a higher interest rate. Some lenders also offer secured personal loans, which require collateral and may offer better terms for subprime borrowers.

Tips Before Applying

-

Check your credit score and improve it if needed

-

Shop around and compare offers from multiple lenders

-

Read the fine print look for fees, prepayment penalties, and total cost of the loan

-

Use a loan calculator to understand monthly payments and total interest paid

✅ Final Thoughts

A personal loan can be a smart, flexible financial tool when used wisely. It offers quick access to funds with predictable repayment terms, and it can help you consolidate debt, cover big expenses, or manage unexpected emergencies.

Before applying, ask yourself:

-

Do I really need this loan?

-

Can I afford the monthly payments?

-

Am I getting the best rate available?

With thoughtful planning and responsible use, a personal loan can support your goals without jeopardizing your financial health.