Imagine this: you suddenly fall ill or get injured and can’t work for weeks or even months. Would you still be able to pay your rent or mortgage? Cover groceries and bills? Support your family?

If the answer is no, then you need to understand disability insurance.

This often-overlooked type of insurance protects your most valuable asset not your car, not your home, but your income.

What Is Disability Insurance?

Disability insurance replaces a portion of your income if you become unable to work due to illness or injury.

Unlike health insurance (which covers medical bills), disability insurance helps you pay everyday living expenses like:

-

Rent or mortgage

-

Utilities

-

Food and groceries

-

Debt payments

-

Childcare

-

Transportation

In short, it’s income protection for when life takes an unexpected turn.

🛡️ What Does Disability Insurance Cover?

Disability insurance covers a wide range of physical and mental health conditions that prevent you from working, such as:

-

Back injuries

-

Cancer

-

Stroke

-

Heart disease

-

Depression or anxiety

-

Arthritis

-

Chronic illness

-

Accidents (car, workplace, home)

Coverage begins after a waiting period (often 30–90 days) and continues for a set duration, which could be a few years—or until retirement, depending on your policy.

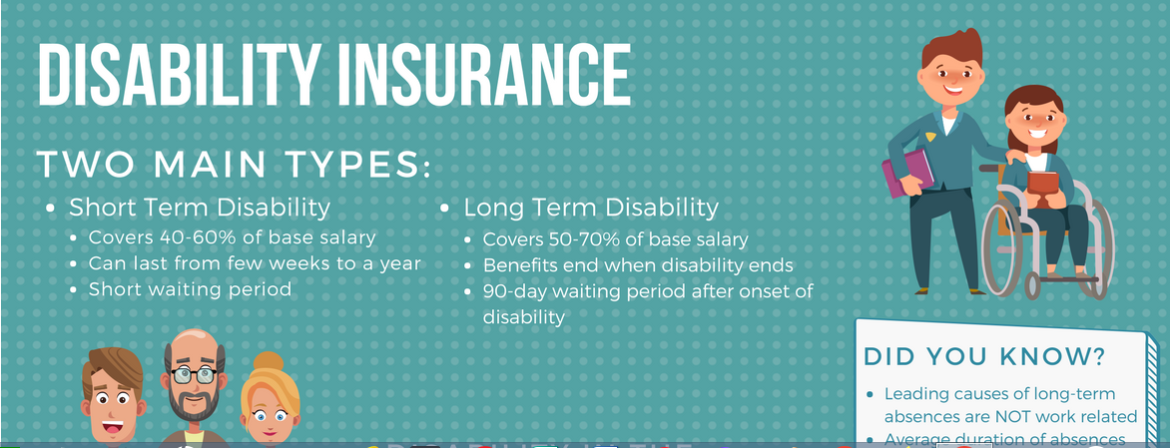

🧩 Types of Disability Insurance

1. Short-Term Disability Insurance

-

Covers disabilities lasting a few weeks to months

-

Usually replaces 50–70% of your income

-

Commonly offered by employers as part of a benefits package

✅ Best for: Temporary injuries or recovery periods (e.g., surgery, childbirth)

2. Long-Term Disability Insurance

-

Covers disabilities lasting months, years, or even permanently

-

Usually replaces 40–60% of your income

-

Often starts after short-term benefits end

✅ Best for: Serious illnesses, injuries, or chronic conditions

🔄 Own Occupation vs. Any Occupation

This is an important distinction in disability policies:

-

Own Occupation: Pays benefits if you can’t perform the duties of your current job, even if you could work in another role.

-

Any Occupation: Only pays if you can’t work in any suitable job based on your education or experience.

🔍 Tip: Own occupation policies are more comprehensive and generally preferred.

💡 Why You Might Need Disability Insurance

🔹 1. Your Income Powers Everything

If you couldn’t work for six months, how would you pay your bills? For most people, a sudden loss of income would cause immediate financial strain.

🔹 2. Accidents and Illnesses Are Common

According to the Social Security Administration, more than 1 in 4 of today’s 20-year-olds will become disabled before retirement age.

🔹 3. Workers’ Comp and Social Security Aren’t Enough

-

Workers’ compensation only covers on-the-job injuries

-

Social Security Disability Insurance (SSDI) is very limited and hard to qualify for

-

Employer coverage may be inadequate or temporary

Having your own policy fills the gaps.

💵 How Much Does Disability Insurance Cost?

Typically, you’ll pay 1% to 3% of your annual income in premiums for long-term coverage.

Costs depend on:

-

Age and health

-

Occupation and income

-

Coverage amount

-

Elimination (waiting) period

-

Benefit period (how long you receive payments)

💰 The healthier and younger you are, the more affordable your premiums will be.

✅ What to Look for in a Disability Insurance Policy

-

Own occupation coverage

-

Non-cancellable and guaranteed renewable policies

-

Adequate benefit amount (aim for at least 60% of your income)

-

Reasonable elimination period (30–90 days)

-

Long enough benefit period (ideally to retirement)

-

Optional riders, such as:

-

Cost of living adjustment (COLA)

-

Partial disability benefits

-

Future purchase options

-

🧠 Final Thoughts

Disability insurance might not be as flashy as life or health coverage, but it’s arguably the most important insurance for working adults. After all, your ability to earn an income powers everything else in your life.