What Is Critical Illness Insurance and Is It Worth It?

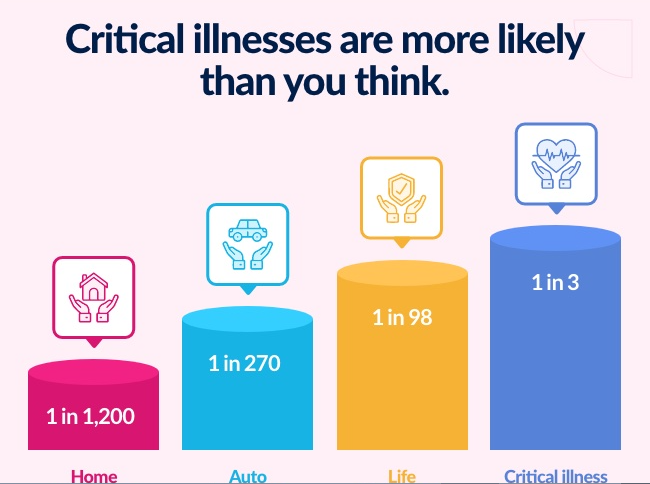

No one wants to imagine being diagnosed with a serious illness but the reality is, life-threatening diseases like cancer, heart attacks, and strokes can strike at any age. And even if you have health insurance, the financial toll of critical illness can be devastating.

That’s where critical illness insurance comes in. But what is it exactly, and is it worth adding to your insurance plan?

Let’s break it down.

🏥 What Is Critical Illness Insurance?

Critical illness insurance is a type of coverage that pays out a lump-sum cash benefit if you’re diagnosed with a specific serious illness covered by the policy.

Common conditions covered include:

-

Cancer

-

Heart attack

-

Stroke

-

Kidney failure

-

Organ transplants

-

Multiple sclerosis

-

Paralysis

-

Coronary artery bypass surgery

Each policy has a defined list of illnesses and must meet certain severity criteria to qualify for a payout.

💵 How Does It Work?

It’s simple:

-

You buy a policy and pay monthly or annual premiums.

-

If you are diagnosed with a covered illness and meet the policy’s terms, you receive a tax-free lump sum.

-

You can use the money however you wish:

-

Pay medical bills not covered by your health insurance

-

Cover lost income if you can’t work

-

Pay for travel, home modifications, or caregiving

-

Cover everyday living expenses while recovering

-

💡 Why Consider Critical Illness Insurance?

Even with regular health insurance, a serious illness can leave you with huge out-of-pocket costs, including:

-

High deductibles and co-pays

-

Non-covered treatments (experimental or alternative care)

-

Out-of-network providers

-

Travel to specialty hospitals

-

Loss of income during treatment and recovery

Critical illness insurance bridges the financial gap so you can focus on healing, not bills.

🧾 What Does It Cost?

Premiums depend on:

-

Age and health

-

Gender

-

Coverage amount

-

Smoking status

-

Length of the policy

For example, a healthy 30-year-old non-smoker might pay as little as $10 to $30 per month for a $25,000 policy. However, costs rise significantly with age or pre-existing conditions.

🧩 Pros of Critical Illness Insurance

✅ Lump-sum flexibility — Use the money however you want

✅ Financial cushion — Helps cover non-medical expenses and lost wages

✅ Peace of mind — Especially if your family has a history of critical illnesses

✅ Simple payout — No complicated reimbursements like traditional health insurance

✅ Complements your health and life insurance — It fills in the gaps, not replaces them

⚠️ Cons and Limitations

❌ Limited illnesses — Only specific conditions are covered (and must meet criteria)

❌ Pre-existing conditions — May not be covered or could increase your premiums

❌ Not a replacement for comprehensive health insurance

❌ Some policies have exclusions, waiting periods, or survival periods (you must survive a set number of days after diagnosis to qualify for the benefit)

🤔 Is It Worth It?

It depends on your situation. Ask yourself:

-

Do you have a family history of critical illness?

-

Could you afford to take months off work to recover?

-

Do you have enough emergency savings to cover the unexpected?

-

Are you self-employed or without robust employer benefits?

If your answer is no to most of these, critical illness insurance can be a smart, affordable safety net.

📝 Final Thoughts

Critical illness insurance may not be essential for everyone—but for many, it provides valuable protection against life’s most unexpected and financially draining health events.