Term vs. Whole Life Insurance: Which One Is Right for You?

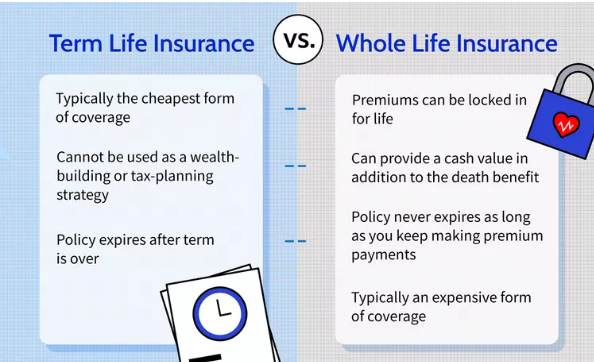

Life insurance is one of the most important financial tools you can have but choosing the right type can feel overwhelming. The two most common options are term life insurance and whole life insurance. While both offer financial protection for your loved ones, they work in very different ways.

In this post, we’ll break down the key differences between term and whole life insurance to help you decide which one fits your needs, goals, and budget.

What Is Term Life Insurance?

Term life insurance provides coverage for a set period of time typically 10, 20, or 30 years. If you pass away during that term, your beneficiaries receive a death benefit (a lump sum of money). If you outlive the term, the policy expires, and you get nothing back.

✅ Pros of period Life:

-

Affordable premiums (especially for younger people)

-

Simple and easy to understand

-

Great for temporary needs (like covering a mortgage or raising kids)

-

Can get higher coverage for less money

❌ Cons of period Life:

-

No cash value or savings component

-

Expires at the end of the term

-

If you need coverage later in life, premiums may be much higher

What Is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides lifelong coverage as long as you pay the premiums. It also includes a cash value component that grows over time on a tax-deferred basis.

This cash value can be borrowed against or withdrawn while you’re alive.

✅ Pros of Whole Life:

-

Lifelong coverage

-

Cash value growth (can be used in emergencies)

-

Fixed premiums (in most cases)

-

May pay dividends (depending on the insurer)

❌ Cons of Whole Life:

-

Much more expensive than term life (up to 10x higher)

-

More complex to understand

-

Cash value grows slowly in the early years

-

Not ideal if your main goal is just income protection

Quick Comparison Table

| Feature | period Life | Whole Life |

|---|---|---|

| Duration | 10–30 years (fixed term) | Lifetime (as long as premiums are paid) |

| Cost | Low premiums | Higher premiums |

| Cash Value | No | Yes, grows over time |

| Flexibility | Can renew or convert to whole life | Less flexible |

| Best For | Temporary coverage, budget-conscious | Lifelong protection, estate planning |

| Death Benefit | Only if you die during the term | Guaranteed if premiums are maintained |

Which One Is Right for You?

The answer depends on your life stage, financial goals, and budget.

Choose period Life Insurance if:

-

You’re young and just starting a family

-

You need affordable coverage to protect your income

-

You want to cover specific obligations (like a mortgage or education)

-

You prefer simple, low-cost protection

Choose Whole Life Insurance if:

-

You want lifelong coverage and guaranteed payout

-

You’re interested in building cash value over time

-

You’re planning for estate taxes or long-term wealth transfer

-

You’ve maxed out other retirement accounts and want a tax-deferred option

Pro Tip: You Can Combine Both

Many people start with term life while they’re younger and then convert to whole life later on if their budget allows. Others may layer both types of policies to meet different needs over time.

Final Thoughts

There’s no one-size-fits-all answer. The best type of life insurance is the one that meets your goals, fits your budget, and gives you peace of mind.

If you’re looking for affordable, straightforward protection, term life is likely your best bet.

If you want lifetime coverage with a savings component, consider whole life insurance.

Before making a decision, speak to a licensed insurance advisor and compare quotes from multiple providers.