Robo-Advisors vs. Human Financial Advisors: Pros & Cons

As more people get involved in investing and financial planning, one of the biggest questions is:

Should you use a robo-advisor or work with a human financial advisor?

Both have their strengths, and the right choice depends on your goals, budget, and how much personal guidance you want. In this post, we’ll break down the pros and cons of robo-advisors and human financial advisors to help you decide which is best for you.

What Is a Robo-Advisor?

A robo-advisor is an online platform that uses algorithms to manage your investments. Based on your answers to a few questions like your risk tolerance, investment goals, and timeline it automatically builds and manages a diversified portfolio for you.

Examples: Betterment, Wealthfront, Risevest, Cowrywise, Bamboo

👨💼 What Is a Human Financial Advisor?

A human financial advisor is a certified professional who provides personalized advice on your finances. This could include budgeting, investing, tax planning, retirement planning, and more. You can meet them in person, online, or over the phone.

Examples: Certified Financial Planners (CFPs), Independent Advisors, Private Bank Wealth Managers

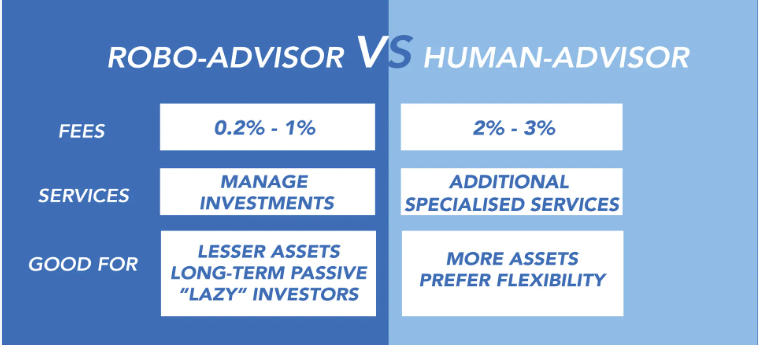

⚖️ Robo-Advisors vs. Human Advisors: Pros and Cons

✅ Pros of Robo-Advisors

-

Low Cost

Robo-advisors typically charge fees ranging from 0.25% to 0.50% of assets under management—much lower than traditional advisors. -

Easy to Use

You can sign up, answer a few questions, and be fully invested in under 10 minutes. -

Low Minimum Investment

Many robo-advisors let you start with as little as $10 or $100. -

Automated Rebalancing

Your portfolio is automatically rebalanced and adjusted over time to keep it aligned with your goals. -

Access Anytime

You can manage your portfolio 24/7 via mobile app or website.

❌ Cons of Robo-Advisors

-

Limited Personalization

Advice is based on algorithms, not your unique life circumstances. -

No Human Interaction

If you need emotional support or custom financial strategies, you’re on your own. -

Not Ideal for Complex Situations

Robo-advisors can’t help much with estate planning, taxes, or major life transitions.

✅ Pros of Human Financial Advisors

-

Personalized Advice

Human advisors take the time to understand your full financial picture—goals, lifestyle, family, career—and build a tailored strategy. -

Emotional Guidance

During market downturns, a human can help you avoid panic-selling or bad financial decisions. -

Comprehensive Planning

They can help with retirement planning, tax strategies, debt management, insurance, and more. -

Accountability Partner

A financial advisor can keep you on track and motivated to reach your financial goals.

❌ Cons of Human Financial Advisors

-

Higher Fees

Many charge 1% or more annually, plus additional fees for specific services. -

Minimum Investment Requirements

Some require you to have $100,000 or more to get started. -

Availability and Access

You may need to schedule appointments and wait for responses—not always ideal if you want fast updates. -

Quality Varies

Not all financial advisors are created equal. It’s important to verify credentials and experience.

🤔 Which One Should You Choose?

| You Should Use a Robo-Advisor If… | You Should Choose a Human Advisor If… |

|---|---|

| You’re just starting out with a small amount to invest | You have a complex financial situation |

| You prefer low fees and automation | You want one-on-one guidance and support |

| You’re comfortable managing your own finances | You’re planning for retirement, estate, or tax needs |

| You want a “set-it-and-forget-it” investing strategy | You value a long-term relationship with an expert |

💡 Hybrid Options: Best of Both Worlds

Some platforms now offer hybrid models, where you get algorithm-based investing plus access to a human advisor when needed.

Examples:

-

Betterment Premium – Offers human advice for a slightly higher fee

-

Vanguard Personal Advisor Services

-

Risevest Advisors (in Nigeria) – Offers human support alongside automated investment

🏁 Final Thoughts

There’s no one-size-fits-all answer. Your decision should be based on how much guidance you want, your financial complexity, and what you’re comfortable paying.

Key takeaway:

If you’re just getting started, a robo-advisor offers low-cost convenience.

If your finances are more advanced or emotional support matters, a human advisor may be worth the cost.