Types of Investments: Stocks, Bonds, Real Estate & More

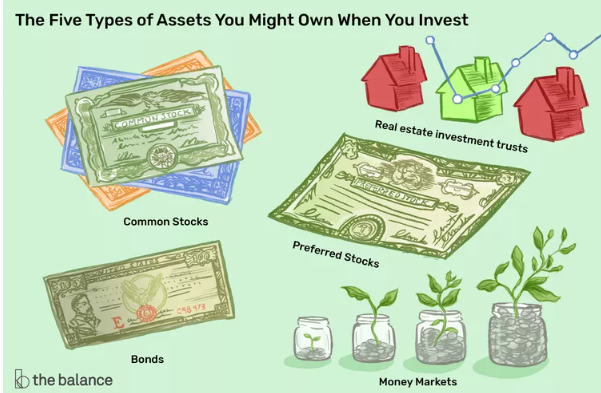

When it comes to growing your wealth, there’s no one-size-fits-all approach. The world of investing offers a wide variety of options, each with its own level of risk, return, and purpose. Understanding the different types of investments available will help you build a diversified portfolio that suits your financial goals and risk tolerance.

In this guide, we’ll explore the most common types of investments including stocks, bonds, real estate, mutual funds, and more so you can make informed decisions about where to put your money.

1. Stocks (Equities)

When you buy a stock, you’re purchasing a share of ownership in a company. As a shareholder, you may earn money through capital appreciation (when the stock price rises) and dividends (a portion of the company’s profits paid to shareholders).

Pros:

-

High return potential

-

Easy to buy and sell (high liquidity)

-

Good for long-term growth

Cons:

-

High volatility and risk

-

Market prices fluctuate daily

Best For:

-

Long-term investors comfortable with risk

2. Bonds

Bonds are essentially loans you give to a government or corporation. In return, they agree to pay you back with interest after a set period.

Pros:

-

Lower risk than stocks

-

Predictable income from interest payments

-

Helps balance a portfolio

Cons:

-

Lower returns than stocks

-

Can be affected by inflation and interest rate changes

Best For:

-

Conservative investors

-

Income-focused strategies

3. Mutual Funds

A mutual fund pools money from many investors to invest in a diversified portfolio of stocks, bonds, or other assets. They’re managed by professional fund managers.

Pros:

-

Diversification reduces risk

-

Professionally managed

-

Accessible to beginners

Cons:

-

Management fees may apply

-

Less control over specific investments

Best For:

-

Beginners and passive investors

4. Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds, but they are traded like stocks on the exchange. They offer diversification and are often low-cost.

Pros:

-

Low fees

-

Easy to trade during market hours

-

Great for tracking market indexes

Cons:

-

May involve brokerage fees

-

Prices fluctuate during the day

Best For:

-

Cost-conscious investors

-

DIY investors who want flexibility

5. Real Estate

Investing in real estate means buying physical property (like homes or commercial buildings) or investing in Real Estate Investment Trusts (REITs).

Pros:

-

Can generate passive income through rent

-

Property values can appreciate over time

-

Tangible asset

Cons:

-

High upfront cost

-

Ongoing maintenance and management

-

Illiquid (can’t sell quickly)

Best For:

-

Long-term investors looking for cash flow

-

Those seeking diversification outside the stock market

6. Cryptocurrency

Cryptos like Bitcoin and Ethereum are digital assets that use blockchain technology. They’re known for high volatility and rapid price swings.

Pros:

-

High return potential

-

Decentralized and accessible

Cons:

-

Very volatile

-

Regulatory uncertainty

-

Not backed by physical assets

Best For:

-

Risk-tolerant investors

-

Tech-savvy individuals exploring alternatives

7. Commodities

These include physical goods like gold, silver, oil, or agricultural products. Investors can buy them directly or invest through commodity ETFs or futures contracts.

Pros:

-

Hedge against inflation

-

Good diversification tool

Cons:

-

Price volatility

-

Complex markets

Best For:

-

Experienced investors

-

Those seeking portfolio diversification

8. Certificates of Deposit (CDs)

Offered by banks, CDs are time deposits that pay interest in exchange for locking up your money for a fixed period.

Pros:

-

Very low risk

-

Guaranteed return

Cons:

-

Money is locked in for a set term

-

Returns are usually lower than inflation

Best For:

-

Very conservative savers

-

Short-term financial goals

Final Thoughts: Diversify for Balance

Each type of investment has its role. While stocks offer growth, bonds provide stability. Real estate and commodities can protect against inflation, while mutual funds and ETFs offer diversification in a single product.

The key is to build a portfolio that aligns with your:

-

Financial goals

-

Investment timeline

-

Risk tolerance

Don’t put all your eggs in one basket. A well-diversified investment mix can help you manage risk while maximizing potential returns.