The Difference Between Saving and Investing

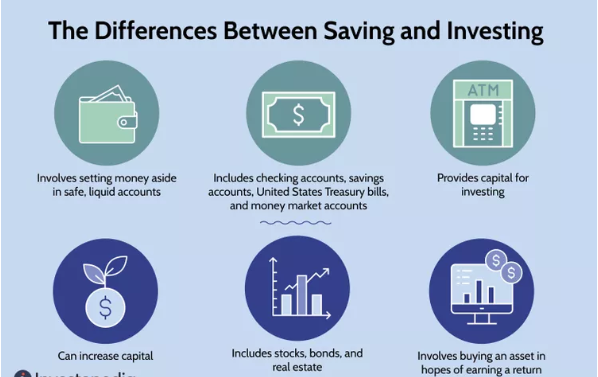

In personal finance, the terms funds and investing are often used interchangeably but they are not the same. Both are essential to a healthy financial life, yet they serve different purposes, involve different levels of risk, and lead to different outcomes.

Whether you’re trying to build an emergency fund or grow long-term wealth, understanding the difference between saving and investing will help you make smarter money decisions.

What Is Saving?

Funds is the act of putting money aside in a safe and easily accessible place, such as a bank savings account. It’s typically used for short-term goals and emergencies.

Key Features of Funds :

-

Low risk: Your money is protected and insured (up to a limit, depending on your country).

-

Low reward: Interest rates on savings accounts are usually minimal.

-

High liquidity: You can quickly withdraw funds when needed.

-

Short-term focus: Ideal for emergency funds, bills, or upcoming expenses.

Examples of Savings Goals:

-

Emergency fund

-

Vacation budget

-

Down payment for a car

-

Rent or tuition savings

What Is Investing?

Investing involves using your money to purchase assets (like stocks, bonds, mutual funds, or real estate) with the goal of growing it over time. Unlike saving, investing carries more risk but also offers the potential for higher returns.

Key Features of Investing:

-

Higher risk: Investment values can go up or down based on market conditions.

-

Higher reward: Over time, investing can significantly grow your wealth.

-

Lower liquidity: Some investments take time to sell or access.

-

Long-term focus: Ideal for retirement, buying a home, or building wealth.

Examples of Investment Goals:

-

Retirement funds

-

Children’s education fund

-

Long-term wealth building

-

Business expansion

Funds vs. Investing: A Side-by-Side Comparison

| Feature | Funds | Investing |

|---|---|---|

| Risk | Very low | Varies (moderate to high) |

| Returns | Low (1–3% typically) | Higher potential (7–10%+ long-term) |

| Purpose | Short-term needs/emergencies | Long-term growth goals |

| Access to Funds | Immediate | May take time to liquidate |

| Security | Bank-insured | Market fluctuations |

When Should You Save?

-

You need the money within 1–3 years

-

You’re building an emergency fund

-

You’re saving for a predictable expense (e.g., rent, school fees, or a planned trip)

-

You want peace of mind knowing your money won’t lose value

When Should You Invest?

-

You won’t need the money for 5 years or more

-

You want your money to grow faster than inflation

-

You’re planning for big future goals like retirement, home ownership, or business

-

You understand and can tolerate some market risk

Can You Do Both?

Absolutely. You should!

Think of saving and investing as working together:

-

Save to protect your present.

-

Invest to secure your future.

For example:

-

Build a 3–6 month emergency fund in a savings account.

-

Then start investing for long-term goals using mutual funds, ETFs, or stocks.

Final Thoughts

Funds and investing aren’t rivals they’re teammates. The key is knowing when to use each strategy based on your goals, timeline, and risk tolerance.

Start by building a solid savings foundation. Once that’s in place, put your money to work through smart investing. Your future self will thank you.