Pros and Cons of Holding vs. Trading Cryptocurrency

Cryptocurrency offers exciting opportunities for both long-term investors and short-term traders. But choosing between holding (HODLing) and trading can be a tough call especially for beginners.

Each approach comes with its own set of rewards and risks, and your decision should depend on your goals, time commitment, and risk tolerance.

In this blog post, we’ll explore the pros and cons of holding vs. trading crypto, so you can determine which strategy fits you best or how to smartly combine both.

What Does “Holding” Mean in Crypto?

“Holding,” often stylized as HODLing, means buying cryptocurrency and keeping it for the long haul — regardless of short-term price volatility. The idea is to ride out market fluctuations and benefit from long-term growth.

✅ Pros of Holding Crypto:

-

Less stress and time commitment

You don’t need to constantly monitor the market. -

Long-term gains

Historically, assets like Bitcoin and Ethereum have appreciated over time. -

Lower fees

Fewer trades mean less spent on transaction or gas fees. -

Tax simplicity

Long-term holdings may enjoy favorable tax treatment in some jurisdictions. -

Good for beginners

A straightforward way to build exposure to the market.

🚫 Cons of Holding:

-

Missed short-term opportunities

You may sit on profits while prices swing up and down. -

Emotional stress during dips

Holding through bear markets can be tough psychologically. -

No gains from market timing

Gains depend on future value, which is never guaranteed.

🔄 What Does Crypto Trading Involve?

Crypto trading means actively buying and selling digital assets to profit from short-term price movements. Traders use tools like charts, indicators, and news to make quick decisions.

✅ Pros of Trading Crypto:

-

Faster profits

You can capitalize on market volatility for quick gains. -

Multiple strategies

Options like day trading, swing trading, and scalping suit different styles. -

Earn in any market

Skilled traders can profit whether prices go up or down. -

Hands-on learning

You’ll quickly learn how the market behaves.

🚫 Cons of Trading:

-

High risk

Mistiming a trade can lead to quick losses. -

Requires skill and discipline

You’ll need to study charts, indicators, and patterns. -

Emotionally demanding

It’s easy to get caught in fear, greed, or FOMO. -

Time-consuming

Constant monitoring and analysis are often required. -

Trading fees add up

Frequent transactions can erode profits over time.

🧠 Side-by-Side Comparison

| Feature | Holding (HODL) | Trading |

|---|---|---|

| Timeframe | Long-term (months to years) | Short-term (minutes to weeks) |

| Effort Required | Low | High |

| Risk Level | Moderate | High |

| Profit Speed | Slow and steady | Potentially fast but uncertain |

| Skills Needed | Basic knowledge | Technical analysis & emotional control |

| Best For | Beginners, long-term investors | Experienced, active users |

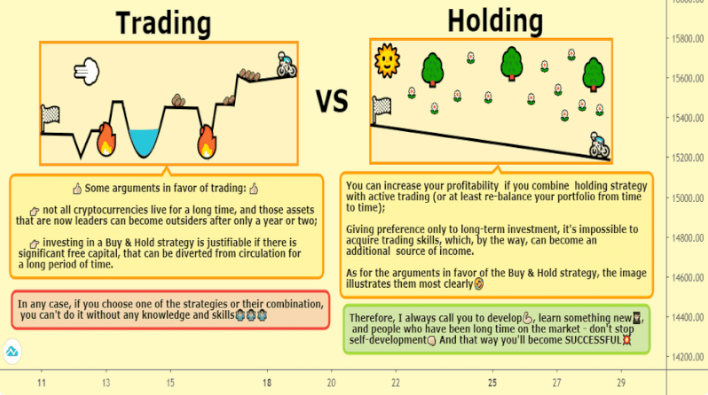

🧩 Can You Do Both?

Yes! Many crypto users combine holding and trading. For example:

-

Hold core assets like Bitcoin and Ethereum long-term

-

Trade small-cap altcoins for short-term profits

-

Use profits from trading to grow your long-term portfolio

This hybrid strategy balances long-term growth with short-term opportunity — and lets you learn without risking your entire stack.

🔐 Tips for Success (Whichever You Choose)

-

Have a clear plan — Know when to buy, sell, or hold

-

Use stop-losses when trading to limit downside risk

-

Secure your assets with trusted wallets and 2FA

-

Avoid emotional decisions based on hype or fear

-

Only invest what you can afford to lose

Final Thoughts

There’s no one-size-fits-all approach to crypto — it depends on your goals, risk tolerance, and lifestyle.

If you prefer a hands-off, long-term strategy: HODLing is for you.

If you enjoy active analysis and fast-paced decision-making: trading could be your edge.

Or, blend both for a flexible, balanced portfolio.