Crypto Wallets Explained: Hot vs. Cold Storage

When you buy cryptocurrency, the first question you’ll face is:

“Where do I store it?”

Unlike traditional money that sits in a bank, cryptocurrency is stored in something called a crypto wallet a tool that lets you securely send, receive, and manage your digital assets.

But not all wallets are created equal. The two main types are hot wallets and cold storage, and each has its pros and cons depending on your needs.

In this post, we’ll break down what each type is, how they work, and which one might be best for you.

What Is a Crypto Wallet?

A crypto wallet doesn’t store your coins physically. Instead, it stores the private keys that give you access to your coins on the blockchain.

Think of it like a digital keyring:

-

Your private key is your secret password (never share it!)

-

Your public key is like your account number — it’s used to receive crypto

-

The wallet helps you use these keys to manage your funds

🔥 Hot Wallets: Always Online

Hot wallets are connected to the internet, making them easy to access for quick transactions.

✅ Pros:

-

User-friendly and ideal for beginners

-

Instant access for trading or sending crypto

-

Often free and available as apps, browser extensions, or desktop software

🚫 Cons:

-

More vulnerable to hacks, malware, or phishing

-

Not ideal for storing large amounts long-term

Examples:

-

Mobile apps: Trust Wallet, MetaMask

-

Web wallets: Coinbase Wallet, Blockchain.com

-

Exchange wallets: Binance, Kraken (Note: Not your keys = not your coins)

Best for: Everyday use, small balances, quick trades

❄️ Cold Wallets: Offline & Ultra-Secure

Cold storage refers to wallets that are offline, making them much harder to hack.

✅ Pros:

-

Very secure against online threats

-

Ideal for long-term holders (HODLers)

-

Gives you full control of your private keys

🚫 Cons:

-

Less convenient for frequent transactions

-

Costs money (in most cases)

-

Risk of losing your device or seed phrase if not backed up

Examples:

-

Hardware wallets: Ledger Nano X, Trezor Model T

-

Paper wallets: Printed QR codes and keys (less common now)

-

Air-gapped computers: Devices kept offline just for crypto storage

Best for: Storing large amounts, long-term holding, serious investors

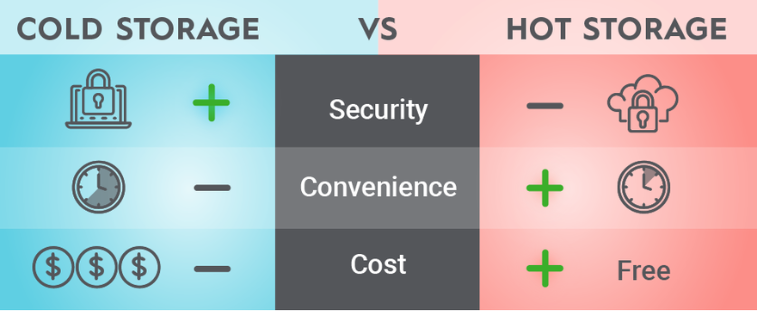

🧠 Hot vs. Cold Wallet: Quick Comparison

| Feature | Hot Wallet | Cold Storage |

|---|---|---|

| Connection | Online | Offline |

| Security | Moderate | Very High |

| Accessibility | Instant | Slower |

| Ease of Use | Beginner-friendly | More technical |

| Cost | Usually free | Hardware costs ~$50–$200 |

| Use Case | Daily trading, small funds | Long-term holding, large funds |

🛡️ Bonus Tips for Wallet Safety

-

Back up your seed phrase and store it offline in multiple secure places.

-

Use 2FA (Two-Factor Authentication) on all accounts.

-

Avoid storing large amounts on exchanges — if the platform is hacked or collapses, your funds may be gone.

-

Keep software wallets updated to patch security vulnerabilities.

-

Test transactions with small amounts before sending large sums.

Final Thoughts

Choosing between a hot wallet and cold storage depends on your goals:

-

If you’re trading regularly, a hot wallet is convenient and efficient.

-

If you’re holding for the long haul, cold storage offers unmatched security.

Many crypto users do both — keeping a small amount in a hot wallet for daily use and the rest in cold storage for safekeeping.